Credit Balance

What is a Credit Balance?

In accounting, a credit balance is an account balance that falls on the credit side of the account.

How it Works

Credit Entries

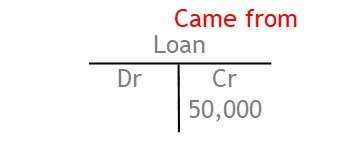

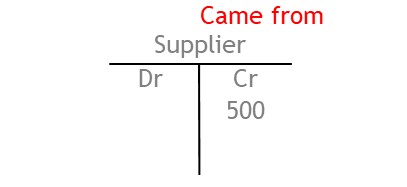

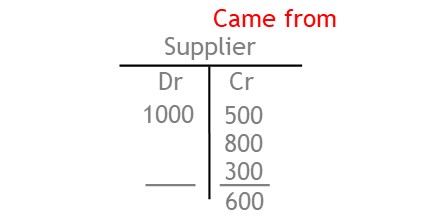

The credit side of an account shows where money or value came from.

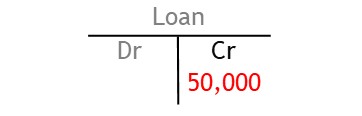

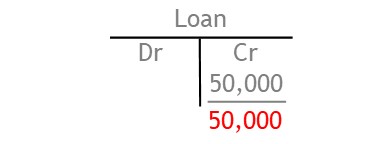

For example, if a business borrows money from a lender, money comes from a loan.

So when recording the the transaction, you credit the loan account.

This shows money came from the loan.

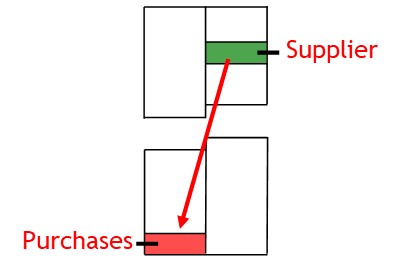

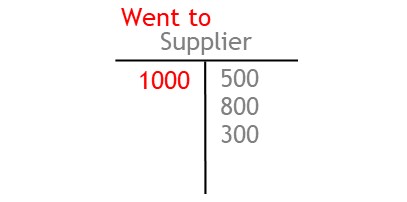

Supplier’s accounts work the same way.

If a business buys goods on credit, those goods come from a supplier.

To record the purchase, you credit the suppliers account.

This shows a value of goods came from the supplier.

Credit Balance

Some accounts have entries on one side of the account only.

In this case, the account’s balance is the total of these entries.

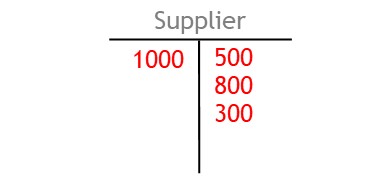

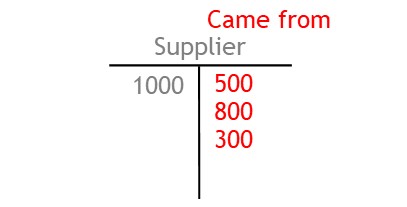

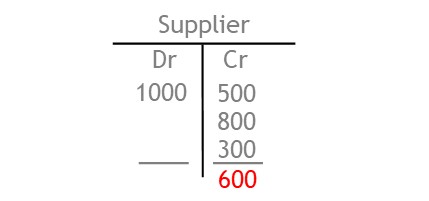

Other accounts will have entries on both sides.

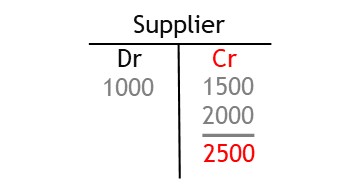

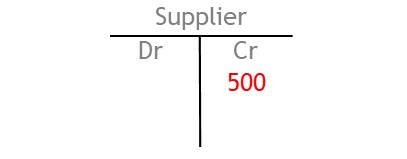

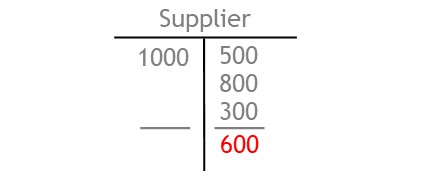

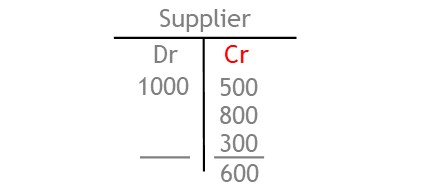

For example, the credit side of the suppliers account will show the value of goods that have come from the supplier.

The debit side of the suppliers account will show how much the business has paid to the supplier.

The account’s balance is the difference between the two sides.

Typically, a supplier’s account will have a credit balance.

This is because a greater value of goods and services has come from the supplier than money has gone to it.

In other words, the account’s balance shows how much money is still owed to the supplier.

© R.J. Hickman 2020