Current Ratio

What is the Current Ratio?

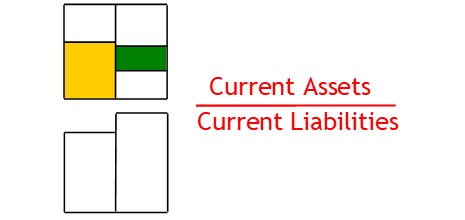

The current ratio is the ratio between current assets and current liabilities—showing the company’s ability to meet short term obligations.

How it Works

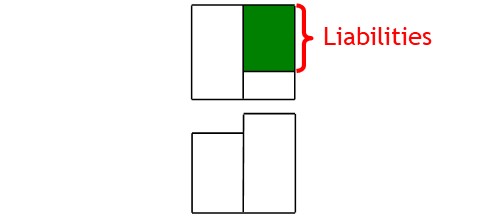

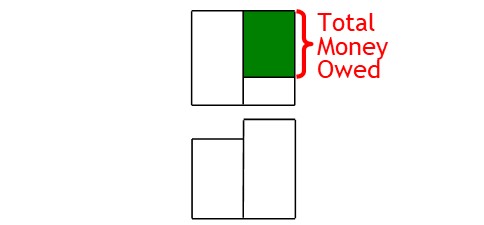

A business will have liabilities.

Liability accounts show how much money the business owes to other people, businesses, and organizations in total.

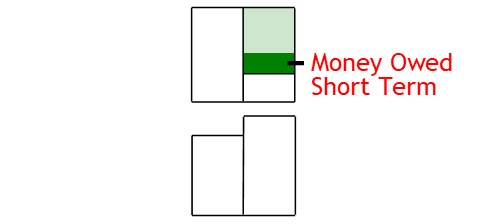

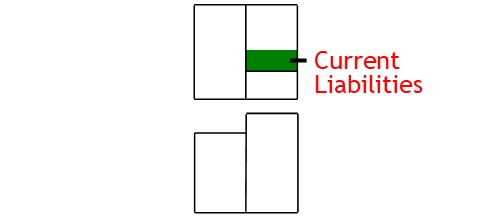

However, management and analysts will be more interested in how much the business owes in the short term.

This is known as current liabilities.

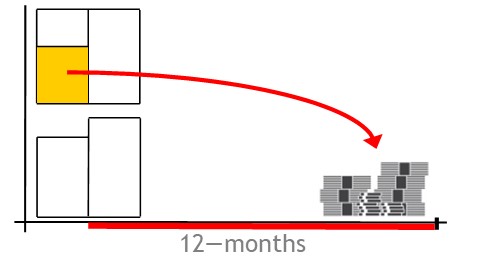

Current liabilities show how much money the business must repay in the coming 12-month period (for more—see current liabilities)

They will want to determine the business’s ability to meet this short term obligation.

To do this, they calculate the current ratio.

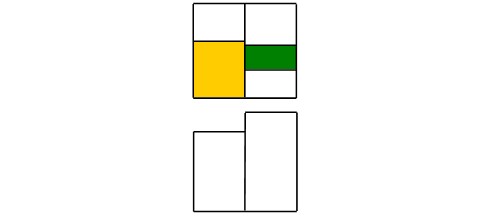

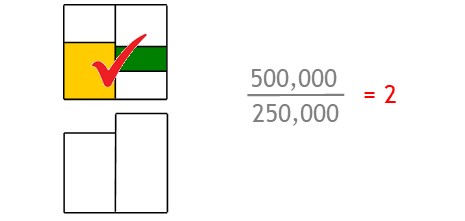

The current ratio is the ratio between current assets and current liabilities.

Current assets include cash and those assets that can be turned into cash within the coming 12-month period (for more, see current assets)

To calculate the ratio, you divide current assets by current liabilities.

The higher the ratio, the more likely the business will meet its short term obligations.

© R.J. Hickman 2020