Defined Benefit Pension Plan

What is a Defined Benefit Pension Plan?

A defined benefit pension plan relies upon a formula to determine payout, as opposed to contributions and market performance.

How it Works

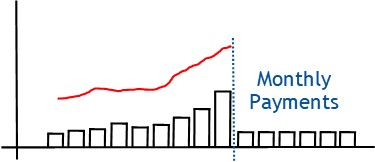

Most pension plans are linked to market performance.

The employee and/or employer made regular payments into the plan.

This money is invested in stocks or bonds.

If the market rises, the retirement plan investment will benefit.

Come retirement, the employee receives pension benefits based upon contribution and market performance.

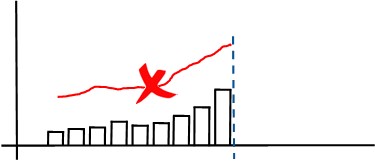

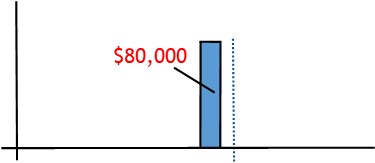

Defined benefit pension plans don’t link to market performance.

Instead, they are dependent on a formula that includes factors such as years of service.

The formula will usually factor in salary level at time of retirement.

It will stipulate that the retirement benefit be paid at a percentage of the final salary level.

By multiplying these two factors together, you arrive at the final payout.

This amount can then be taken as a lump sum or a regular retirement payment.