Debits & Credits

Double Entry Accounting SystemDebits & Credits

Suppose you were keeping the accounting records for a retail store that had just opened.

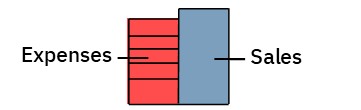

You could attempt to keep those records by simply recording the business’s sales and costs.

The problem is a business may make many transactions during an accounting period.

If only some of these transactions are incorrect, your period-end accounting records will be unreliable and totally useless.

To overcome this problem, businesses use the double-entry accounting system.

This system wasn’t designed to make recording simple.

Instead, it was designed with checking in mind.

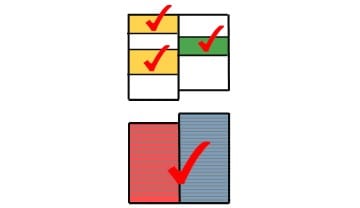

With the double-entry system, you still record sales and costs.

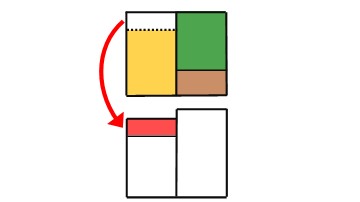

By using a double entry, however, you record a duplicate record of those transactions in other accounts, as well.

This duplicate record is in a convenient format for checking.

It allows for fast, easy, and reliable checking against the records of other businesses.

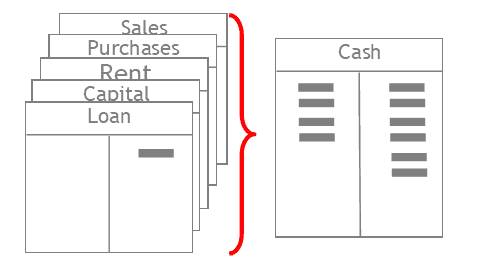

There are three primary control accounts.

By checking these accounts alone, you can make sure your entire record of sales and costs is correct.

Accounts

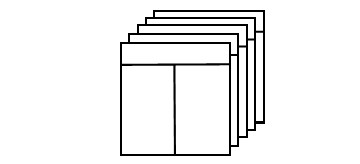

Making all this possible is a system of accounts.

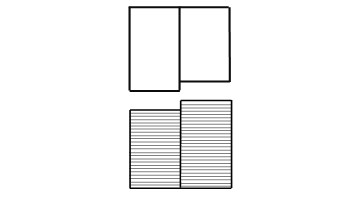

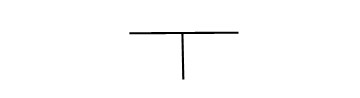

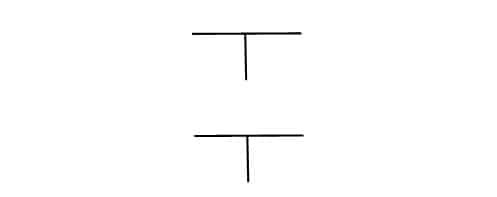

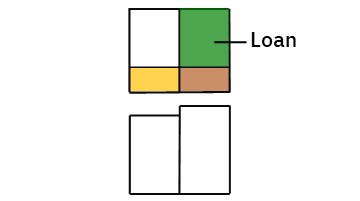

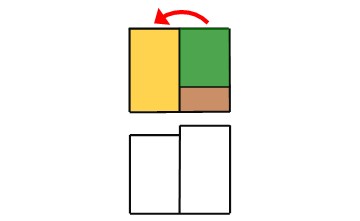

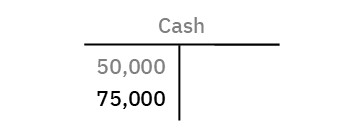

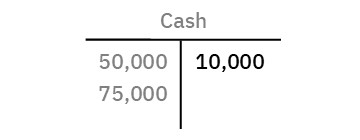

For explanation purposes, these accounts are shown as T Accounts.

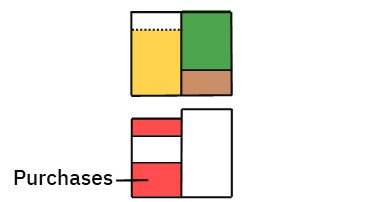

Each account is divided into two sides.

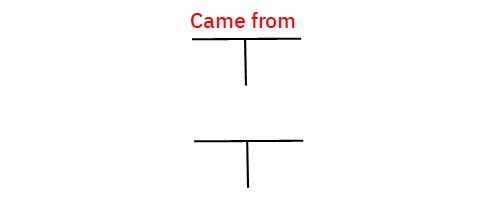

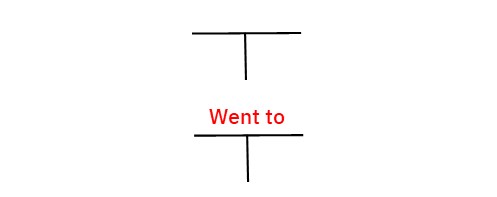

The reason for this is because each transaction is deemed to have two sides.

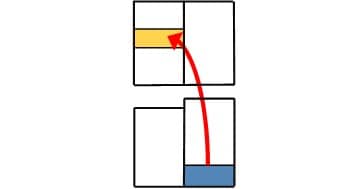

In every transaction, money or value comes from somewhere.

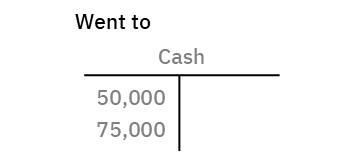

And that money or value was used somewhere—or it went somewhere.

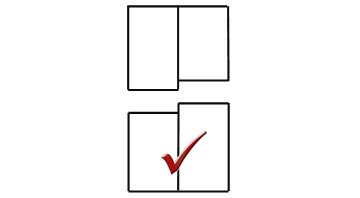

As such, to record each transaction, you use two or more accounts.

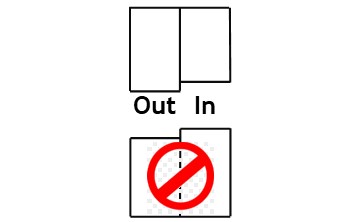

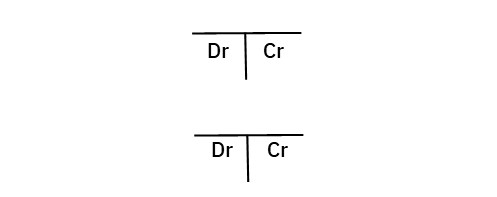

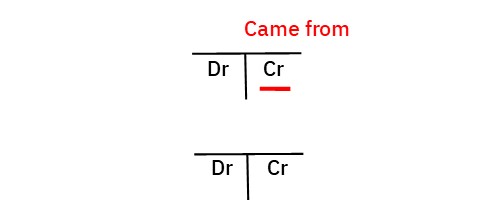

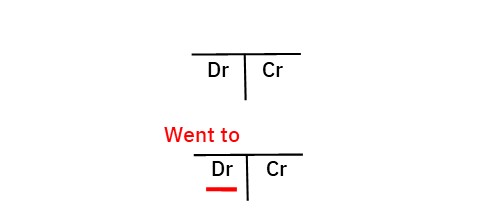

Furthermore, each account is divided into a debit side and a credit side.

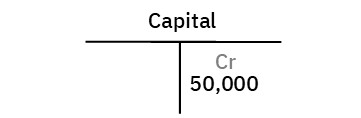

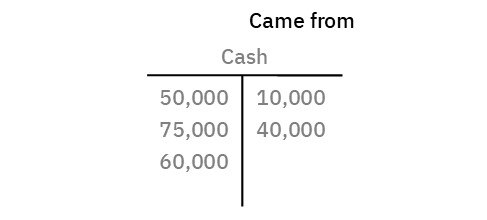

You use the credit side of one account to show where money or value came from.

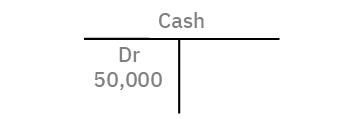

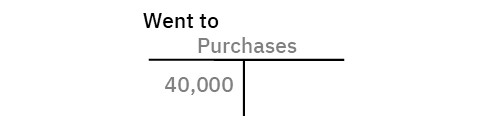

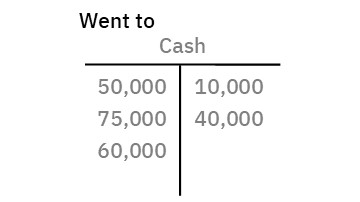

And you use the debit side of another account to show what the money or value was used for—or where it went.

Cash Transactions

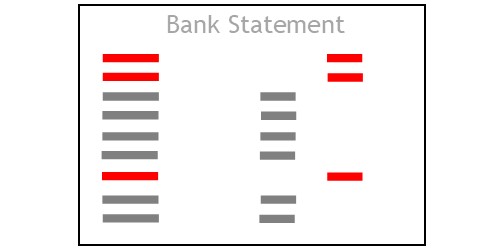

Cash transactions are those the business makes with the bank and are shown on the bank statement.

They include cash receipts, which are shown as deposits on the bank statement.

And they include cash payments, which are shown as withdrawals on the bank statement.

As each cash transaction results in money either coming from the bank or going to it, you end up with a record of each & every cash transaction in an account known as a cash account.

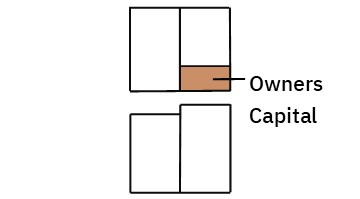

For example, to start up, the owner may have put some of their own money into the business.

They would deposit this money in the business’s bank account.

To record this transaction, you credit the capital account.

This shows that the money came from the owner’s capital.

At the same time, you debit the cash account.

This shows the money was deposited in the bank.

The business owner may also borrow some money from a friend or a relative.

They will deposit this money in the bank, as well.

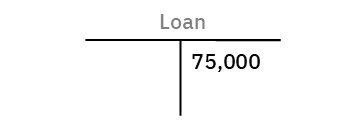

To record this transaction, you credit the loan account.

This shows money came from a loan.

Then you debit the cash account.

This shows the money was deposited in the bank.

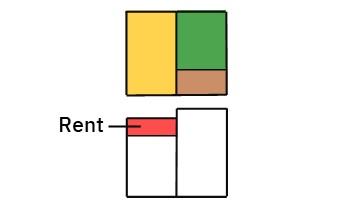

After this, the business owner may rent premises for the store.

Here, they would take money from the checking account and send it to the landlord.

To record this transaction, you credit the cash account.

This shows money came from the bank.

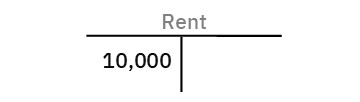

Then you debit the rent account.

This shows the money was used for rent.

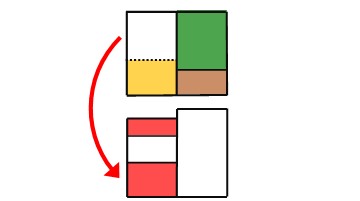

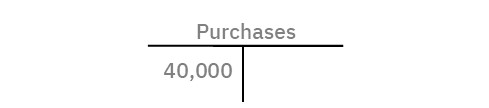

After this, the business owner may buy goods to sell in the store.

Again, they take money from the bank and use this money for purchases.

To record the purchase, you credit the cash account.

This shows money came from the bank.

Then you debit the purchases account.

This shows the money was used for purchases.

The store will then sell these goods.

If cash sales, the business will deposit the takings in the bank.

To record the transaction, you credit the sales account.

This shows the money came from sales.

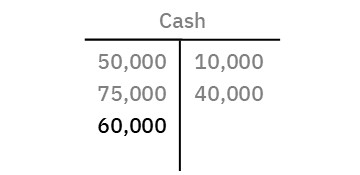

Then you debit the cash account.

This shows the takings were deposited in the bank.

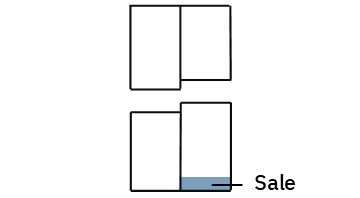

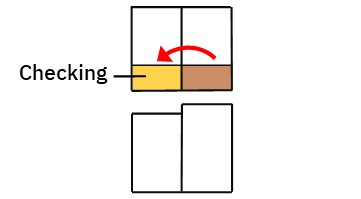

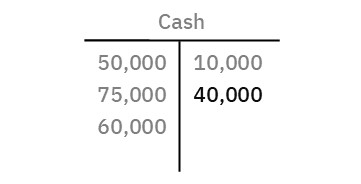

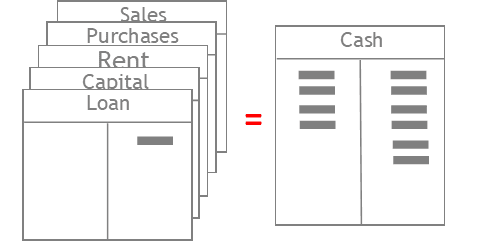

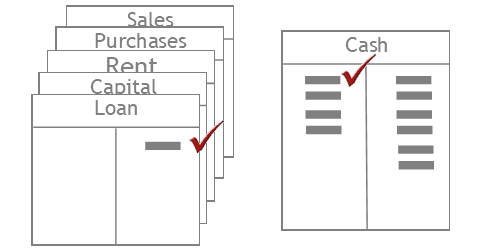

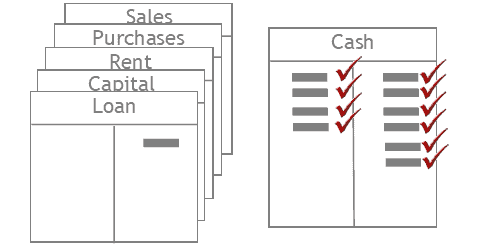

By month end, you should have a complete record of cash transactions.

You will have one record of them in the general accounts.

And because you use a double entry, you will have a duplicate record of those transactions in the cash account.

As such, the cash account should contain the same transactions as shown in the other accounts.

So for your record of transactions to be correct, they should be the same as those shown in the cash account

This is why the checking account is known as a control account.

All you need check is the control account.

If correct, because of the double-entry, all the other accounts should be correct, as well.

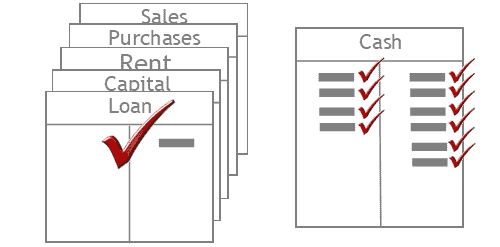

To check your record of cash transactions, you compare your checking account to the month end bank statement.

If the records agree, it shows the control account is correct.