Deferred Expense

What is a Deferred Expense?

A deferred expense is an expense that has been paid for now but is not recognized until it is actually used.

How it Works

Sometimes, a business will pay for an expense in advance.

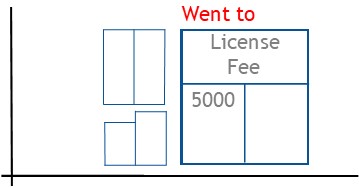

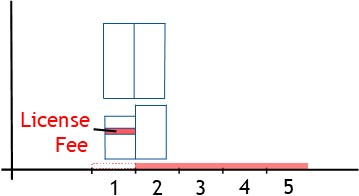

For example, the business may pay license fees in advance.

This could be for years in advance.

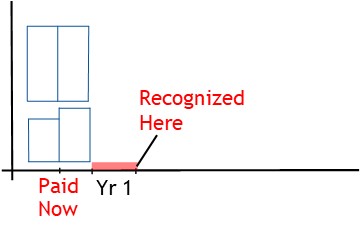

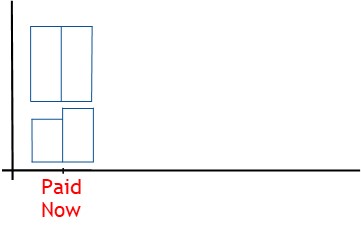

In such cases, payment for the expense is made now.

However, the expense is not used until later.

Accordingly, it is more appropriate to record the expense when it is used.

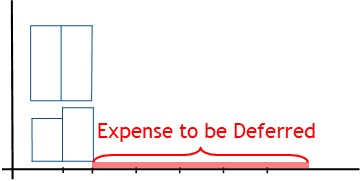

In order to do this, you first need to defer the expense.

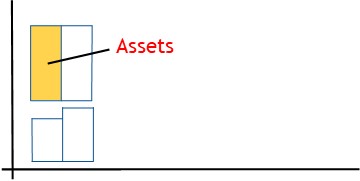

Here, you defer the entire expense to an asset account.

Asset accounts show money that belongs to the business or value that is owed to it.

The money paid in advance has not been used yet.

This means the value involved in the transaction still belongs to the business.

And it should be held in an asset account until it is used.

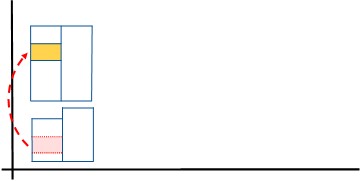

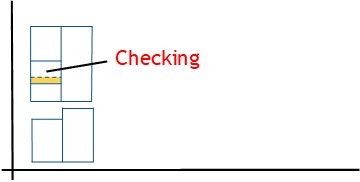

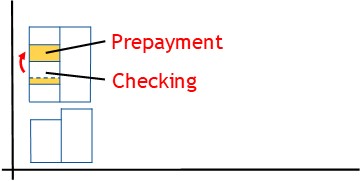

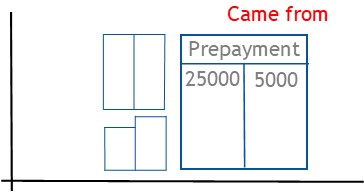

The money for the expense is paid from the checking account.

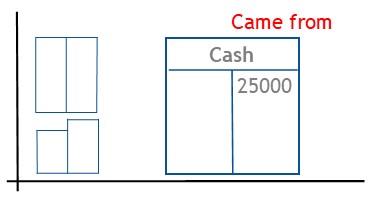

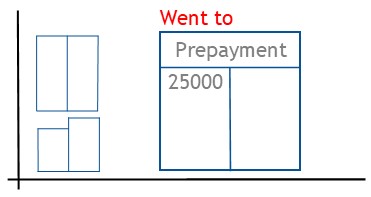

So to record the deferral, you begin by crediting the checking account.

This shows money came from the bank.

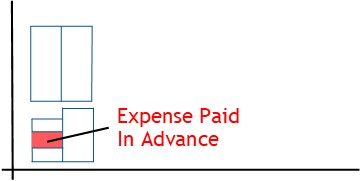

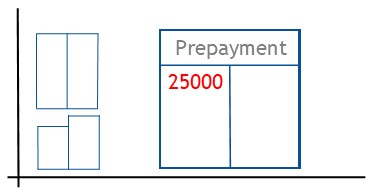

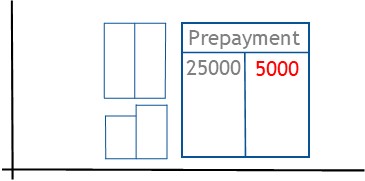

At the same time, you debit a prepayment account.

This shows the money will be used for a deferred expense.

When complete, the transaction will show that money came from the bank and will be used for a deferred expense.

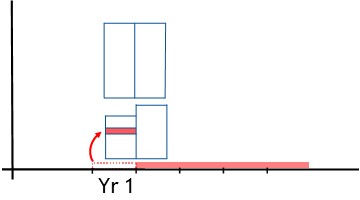

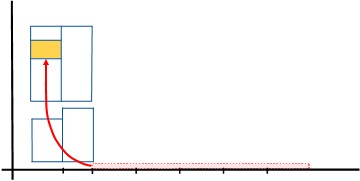

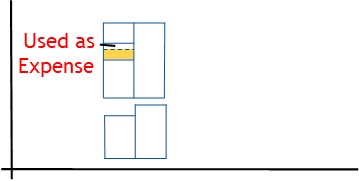

Later on, you will need to record the expense.

Here, you need to calculate the used portion of the prepayment.

Then you transfer that amount to the expense account.

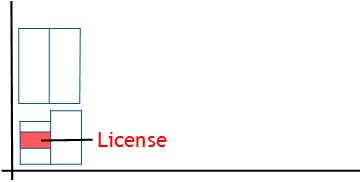

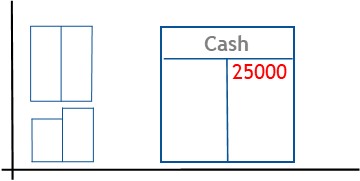

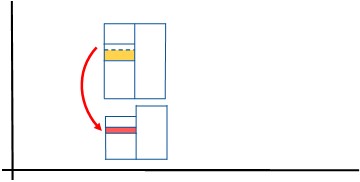

To record the transaction, you credit the prepayment account.

This shows you have taken value from the deferred expense account.

Then you debit the expense account.

This shows the money was used for expense.