Deferred Revenue

What is Deferred Revenue?

Deferred revenue is income received now but recognition of that income is deferred until after the work is completed.

How it Works

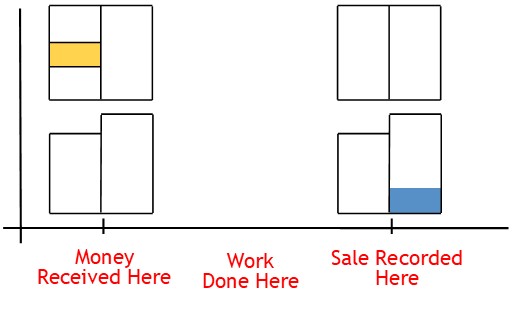

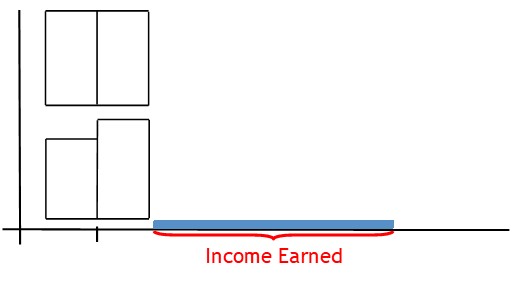

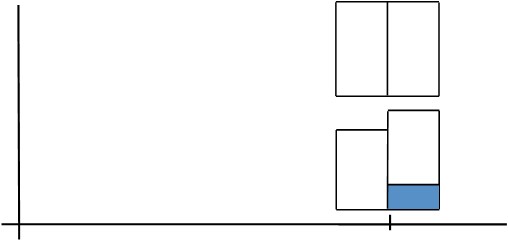

Sometimes, a business will receive money in advance for work it is yet to perform.

Here, the business receives the money now.

But the income will actually be earned later.

According to accounting principles, the cash receipt should not be recognized as a sale until the work has actually been done.

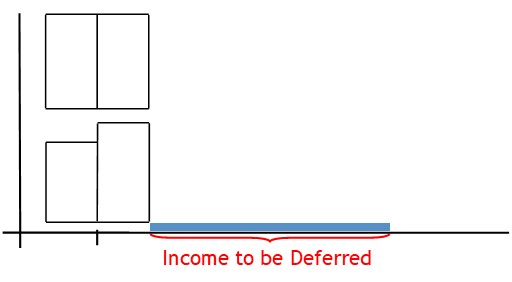

In order to do this, you first need to defer income.

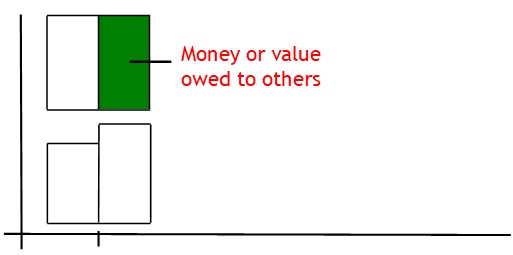

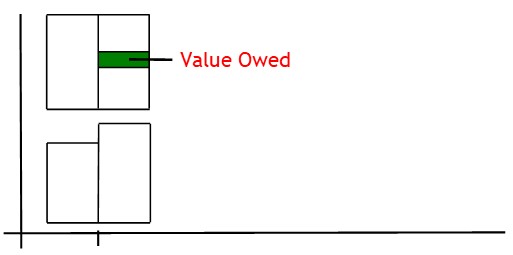

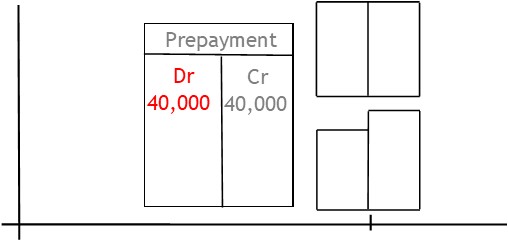

Here, you defer income received in advance to a liability account.

Liability accounts show money owed to others.

Until the work is performed, this payment is still owed to the customer or client..

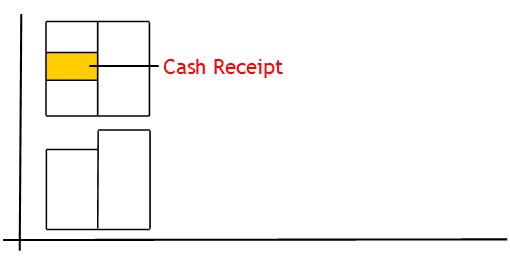

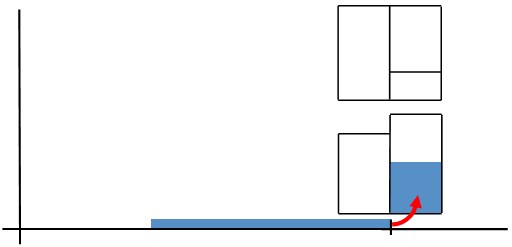

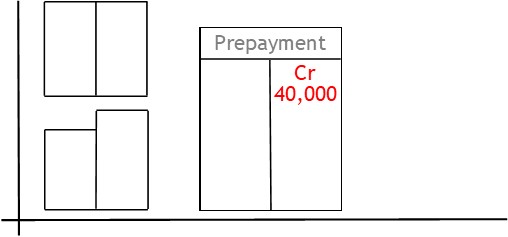

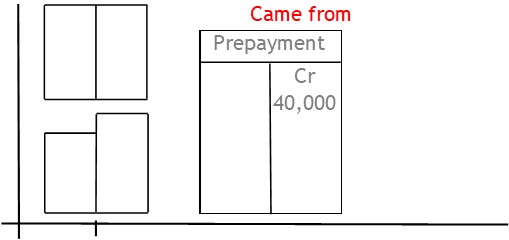

To record the transaction, you credit the prepayment account.

This shows that the money came from a prepayment.

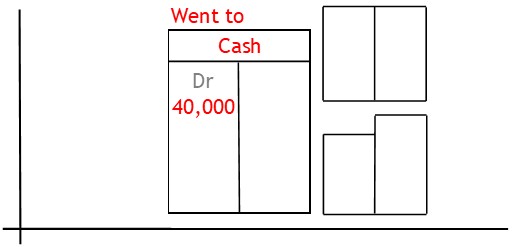

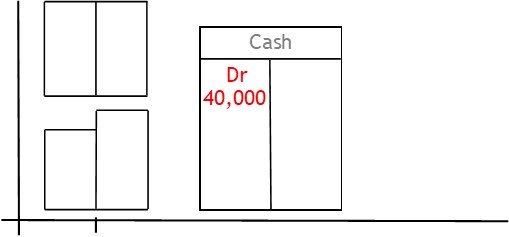

At the same time, you debit the checking account.

This shows the money went to the bank.

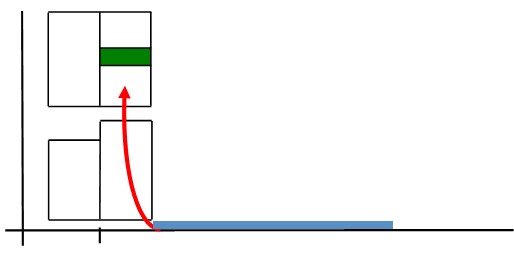

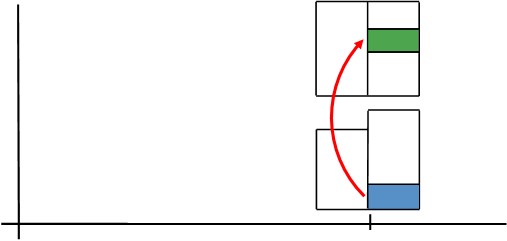

Eventually, the business will complete the work.

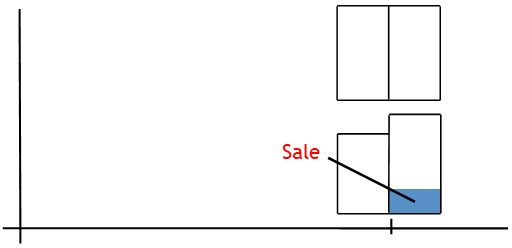

At that point, you can recognize the sale.

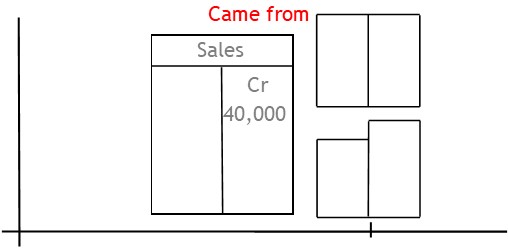

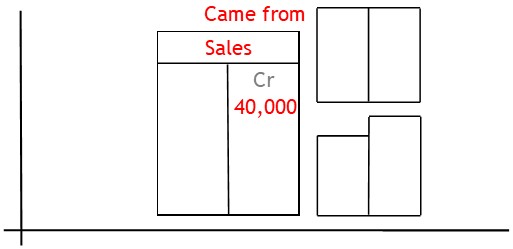

To do this, you show that money has come from sales.

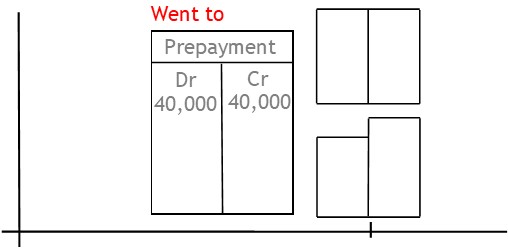

Then you show that value went to the prepayment account.

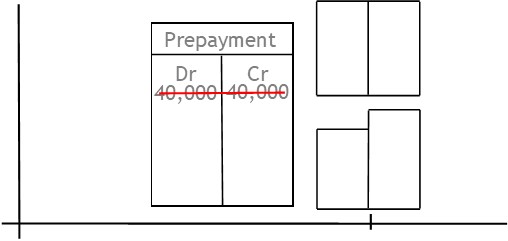

This offsets the original entry showing that money was owed to the customer.

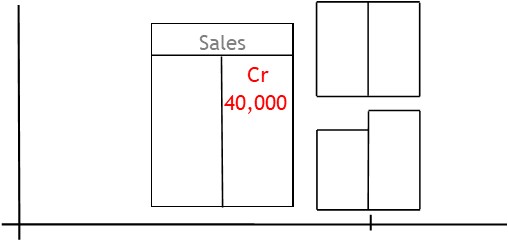

To record the transaction, you credit the sales account.

This shows money has come from sales.

Then you debit the prepayment account.

This shows you have sent the sale value to the prepayment account.

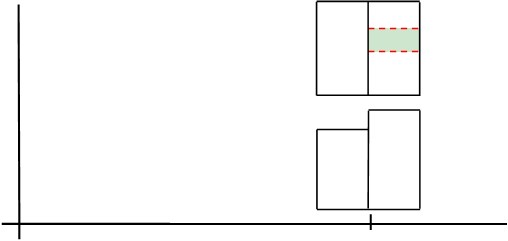

Once updated, the prepayment account’s entries will offset one another.

The sales account will show that money came from sales.

And that money was deposited in the bank.