Discount Received

What is Discount Received?

A discount received is a discount received by a customer who has bought goods.

How it Works

A business may buy goods on credit.

This means the business can pay for the goods later.

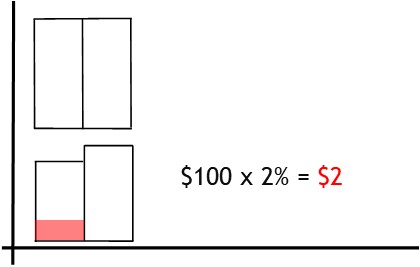

To encourage early payment, the seller may offer a discount for paying early.

If the business takes up the offer, they will pay the purchase price less the discount amount.

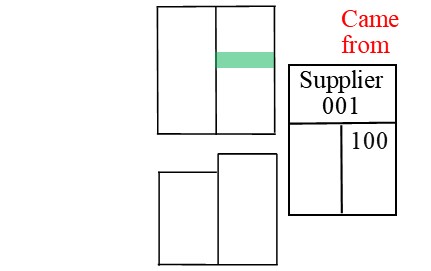

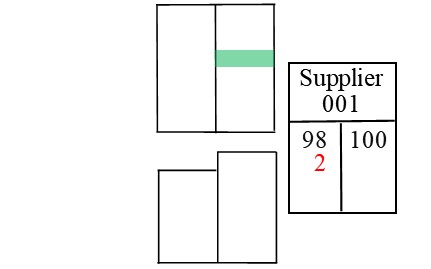

Recording the Initial Transaction

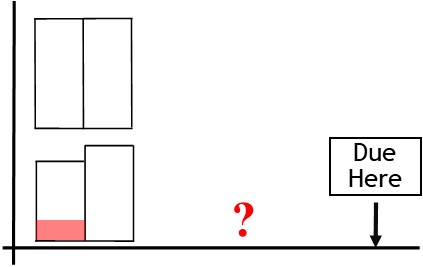

Despite the discount offer, the business may not pay for the goods earlier than the due date.

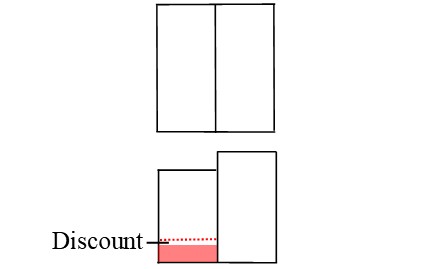

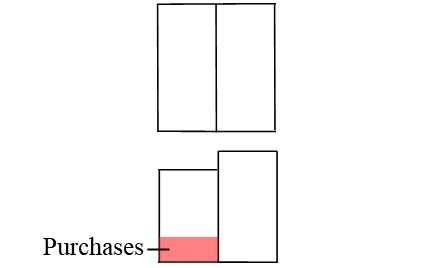

Because of this, you record the purchase’s full value when the purchase is made.

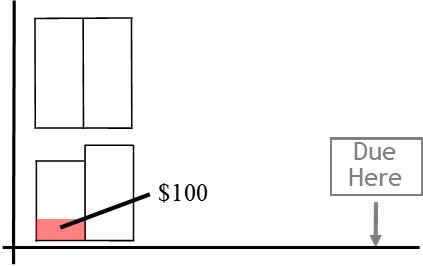

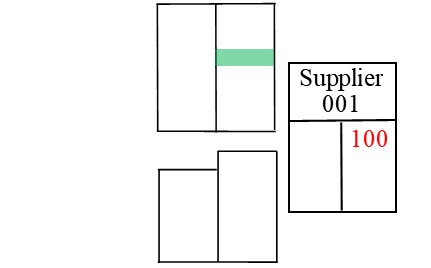

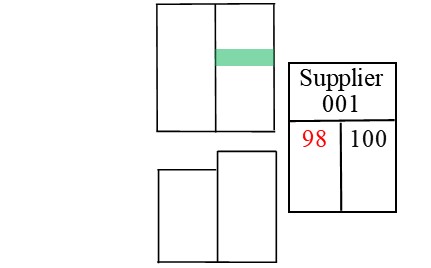

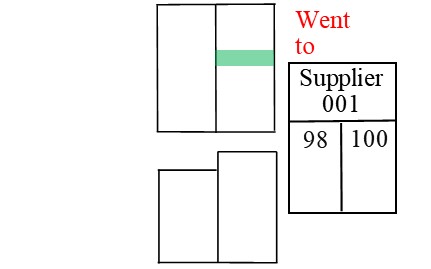

To record the purchase, you credit the supplier’s account

This shows the goods came from the supplier.

After this, you debit the purchases account.

This shows the goods were used for purchases.

Recording the Discount

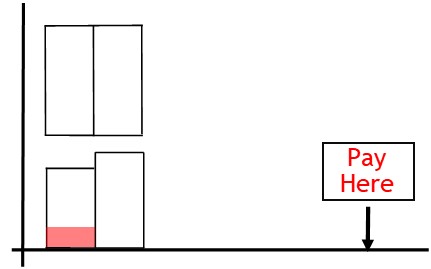

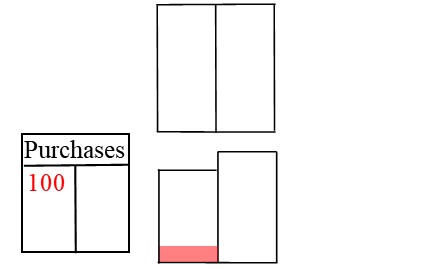

In the end, the business may opt to pay ahead of time.

This will entitle them to a discount.

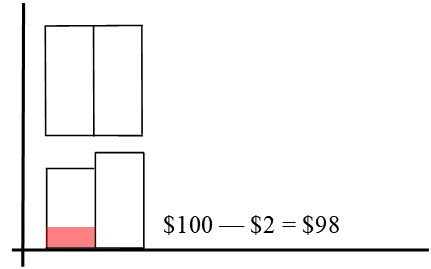

When the business pays, it will pay what they owe net of the discount.

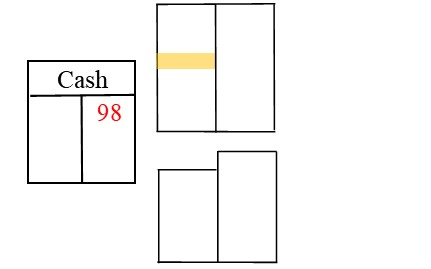

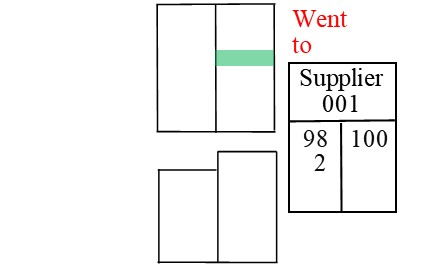

To record the transaction, you credit the checking account.

This shows money came from the bank.

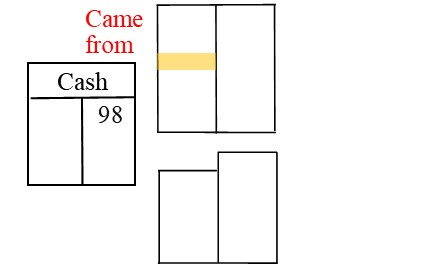

After this, you debit the supplier’s account.

This shows the money went to the supplier.

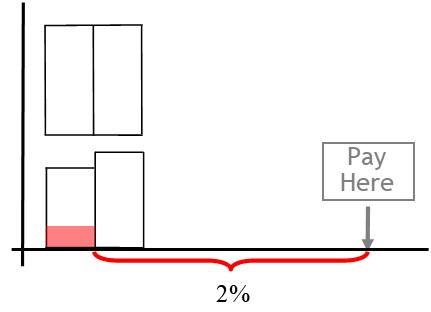

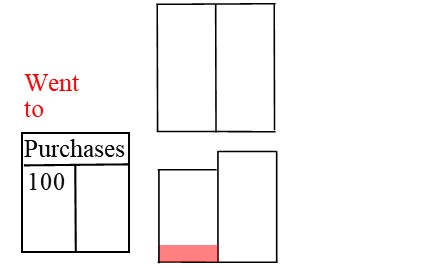

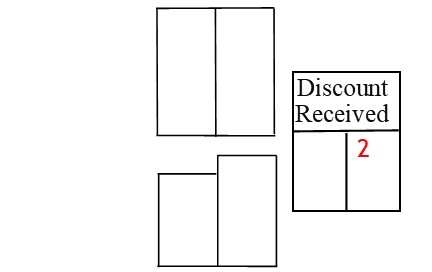

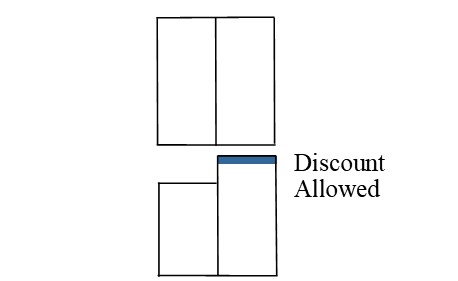

Next, you need to account for the discount.

Here, you credit the discount received account.

This shows that the value has come from the discount.

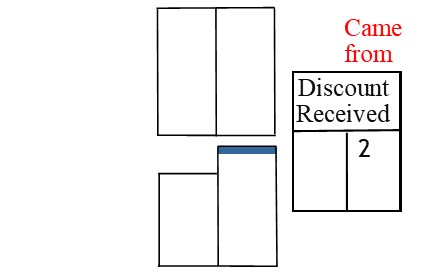

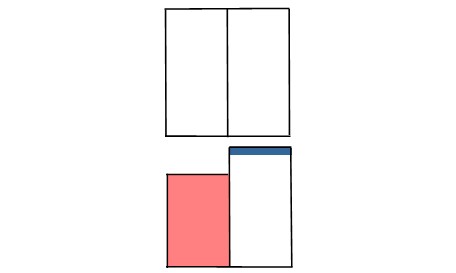

Then you debit the suppliers account.

This shows the value was used to make up the difference of the balance owing.

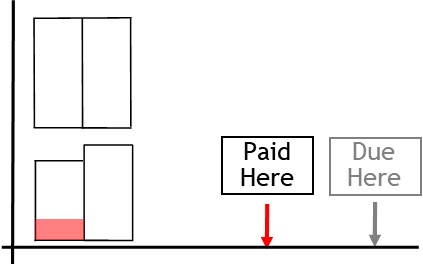

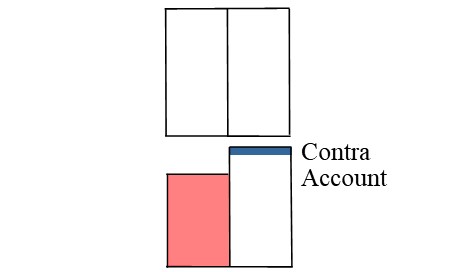

The discount received account is a contra expense account.

In other words, it is classified as a expense account.

But because it balances on the credit side, it is said to be contra account.

© R.J. Hickman 2021