Discount On Bonds Payable

What is Discount On Bonds Payable?

A discount on bonds payable is the discount a bond issuer must offer to attract investors if interest rates have risen ahead of the bond issue.

How it Works

A company may require funding for a proposed project.

One way for the company to raise money for is by issuing bonds.

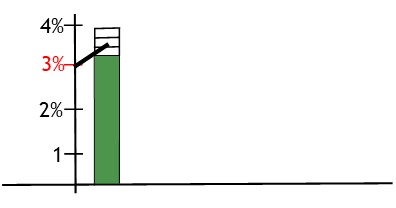

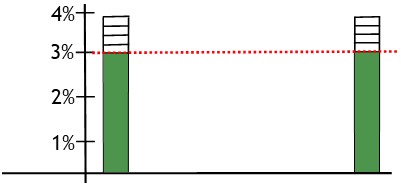

When issuing their bond, the bond’s issuer will consider the current level of interest rates.

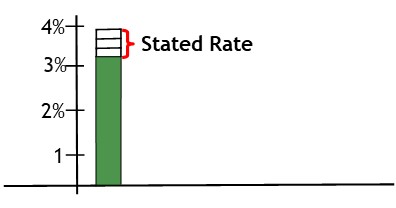

They will set their bond’s coupon rate at or around this level.

This is known as the stated rate.

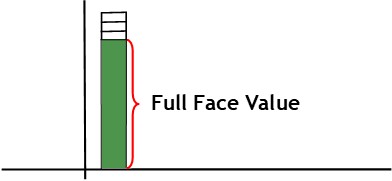

When selling the bonds, the issuer hopes to sell them for par value.

This way, they receive the full face value of each bond from investors.

With bond issuance, though, there is quite a bit to prepare beforehand—getting approval, printing of bond certificates, arranging sellers etc.

Often, administrative problems can delay the bond issue.

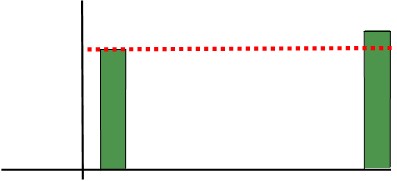

If interest rates are volatile during this time, they can move quite a bit during such delays.

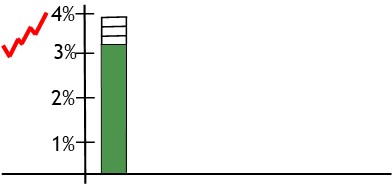

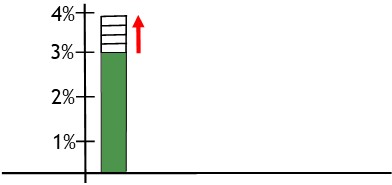

Sometimes, interest rates will rise ahead of a bond issue.

Should this happen, investors will lose interest in the issue.

They can get a better rate elsewhere.

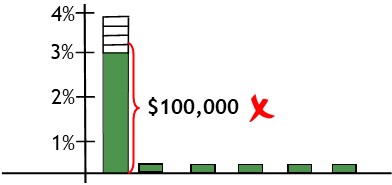

In this event, the issuer will need to discount their bonds.

Discounting the bond effectively increases the interest rate.

This will bring the bond into line with competing bonds.

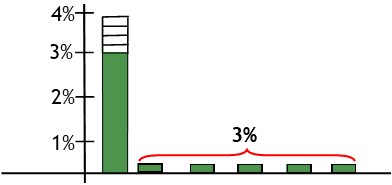

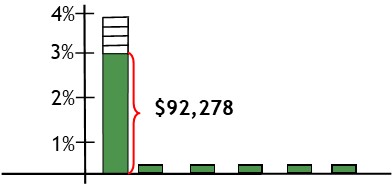

With discounted bonds, the bond holder still only receives the stated interest rate each year.

However, they offset this with the bond price.

With a discounted bond, they don’t pay full price.

Instead, they buy the bond at a discount.

Later, when they redeem the bond, they will receive full face value.

In other words, they will get back more than they paid.

This tops up what they receive in interest payments.

Adding the interest payments and the discount together will improve the bond’s yield.

Accounting for Discounted Bonds Payable

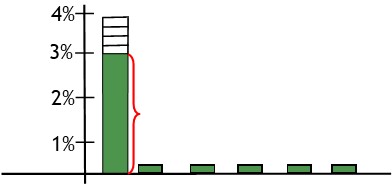

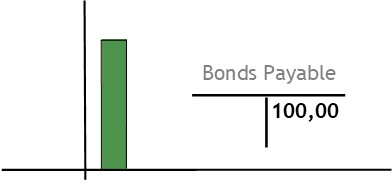

You begin by recording the bond as if it wasn’t discounted at all.

To do this, you credit the bonds payable account with the bond’s full face value.

This shows the total value coming from the bond.

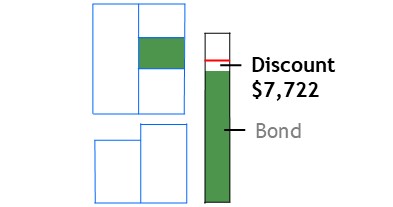

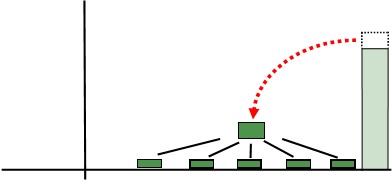

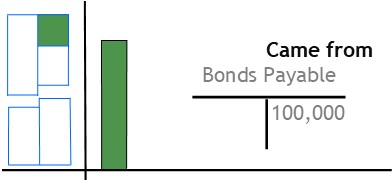

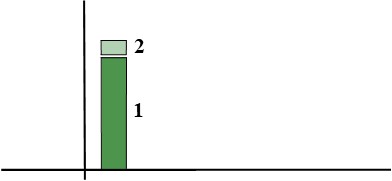

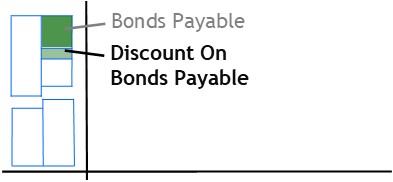

The bond’s total value is made up of two parts.

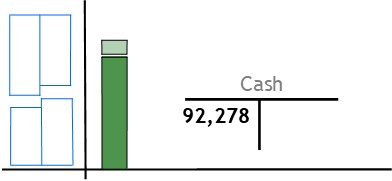

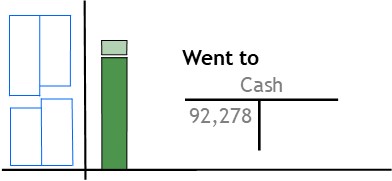

One part is the money received from the investor.

This money is deposited in the bank.

To record the deposit, you debit the cash account.,

This shows the money went to the bank.

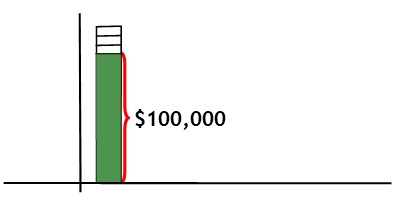

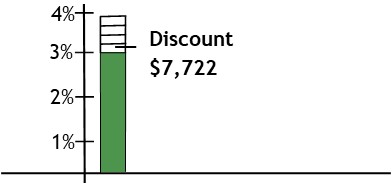

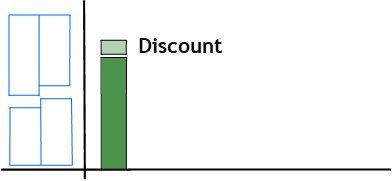

The other part of the bond’s value is the discount itself.

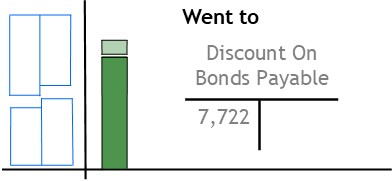

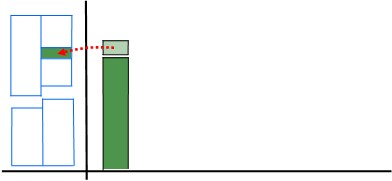

You assign this portion of the bond’s value to the discount on bonds payable account.

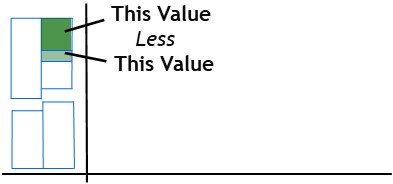

The discount on bonds payable account is a contra liability account, attached to the bonds payable account.

It’s a valuation account that decreases the value of the bonds payable account.

To record the discount, debit the discount on bonds payable account.

This shows you have assigned the discount’s value to that account.