Double Declining Balance Method of Depreciation

What is the Double Declining Balance Method of Depreciation?

The double declining balance method of depreciation is an accelerated depreciation rate applied at double the straight line rate.

How it Works

A business’s asset’s will lose value over time due to depreciation.

You need to record each year’s loss of value as depreciation expense.

Double Declining Balance Method

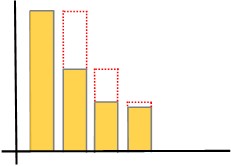

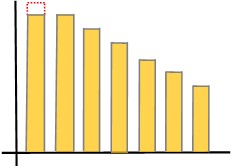

One way to depreciate the asset’s value is with the double declining method.

You use this method if you want to really accelerate loss of value, initially.

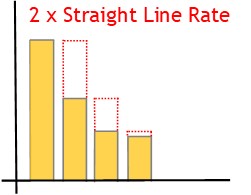

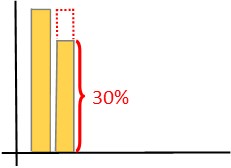

Here, you base the depreciation rate on the straight line depreciation rate.

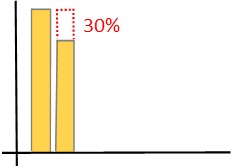

First, you calculate the rate.

Then double it.

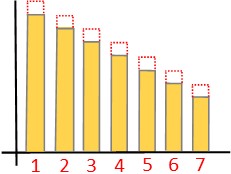

And apply the rate to the asset’s balance, each year.

Calculating Straight Line Depreciation Rate

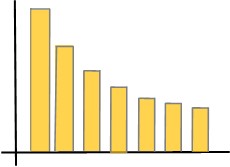

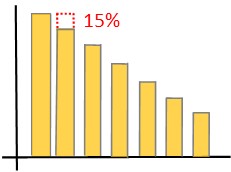

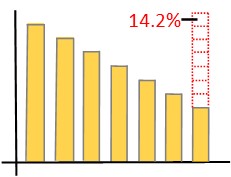

With the straight line method, you depreciate the asset by the same amount each year.

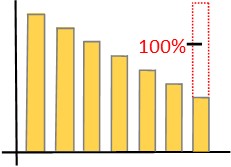

And you do this for so many years.

By the end of the asset’s useful life, you will have depreciated 100% of the asset’s depreciable value.

So to determine the depreciation rate, take divide 100% by the number of years.

This will show the annual percentage of depreciation.

© R.J. Hickman 2020