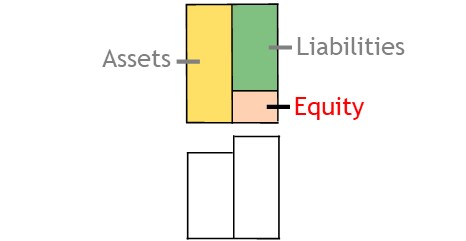

Equity

What does Equity Mean?

In accounting, equity refers to the difference between assets and liabilities.

How it Works

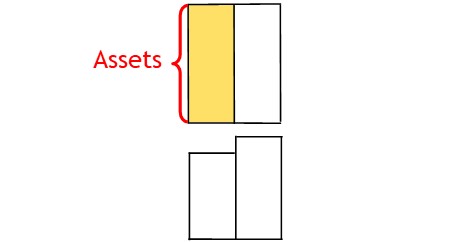

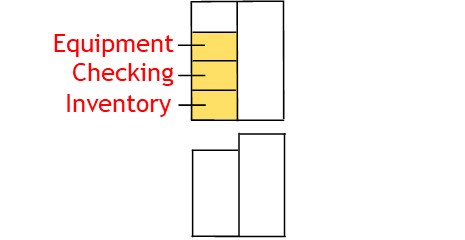

Assets

A business will have assets.

Assets are things the business owns, such as money in the bank, equipment, and inventory.

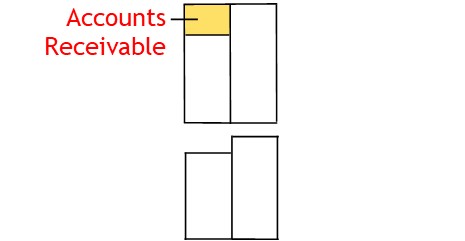

They also include money owed to the business by customers.

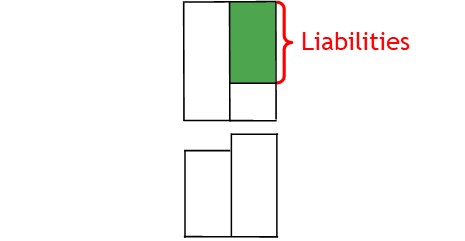

Liabilities

The business will also have liabilities.

Liabilities show what the business owes to others.

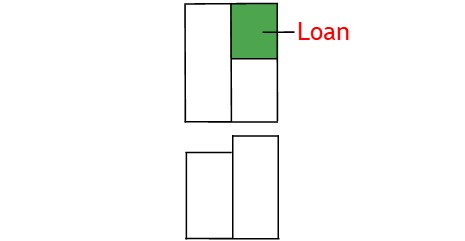

Loan accounts show money owed to lenders.

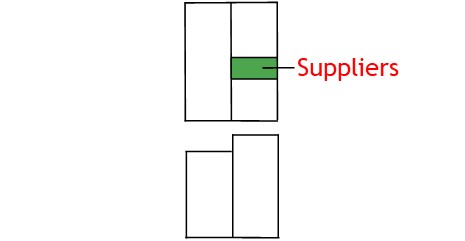

Supplier accounts show money owed to suppliers.

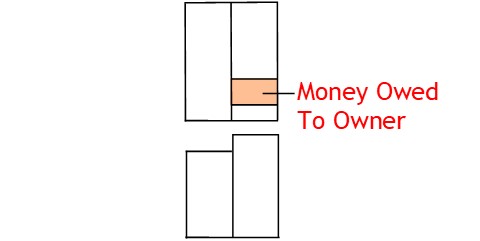

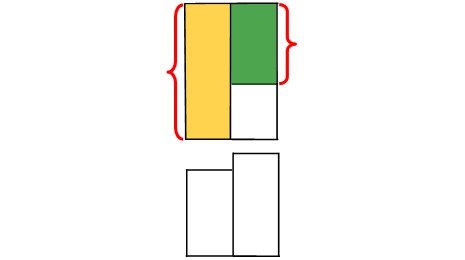

Equity Make Up

Equity is the difference between assets and liabilities.

It shows the money owed to the business owners or shareholders.

In part, equity is made up by capital.

This is money that comes from the business owner themselves or from stock holders.

In other words, it is money the business owes to its owners.

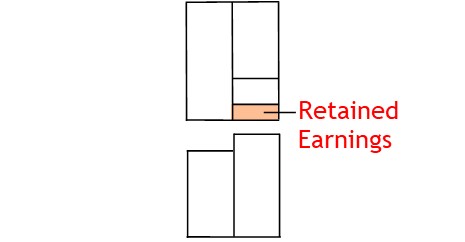

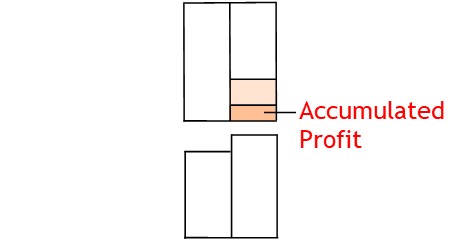

Equity also includes retained earnings.

Retained earnings is accumulated net profit.

At period-end, net profit is transferred to retained earnings.

This, then, also becomes money owed to the owner or shareholders.

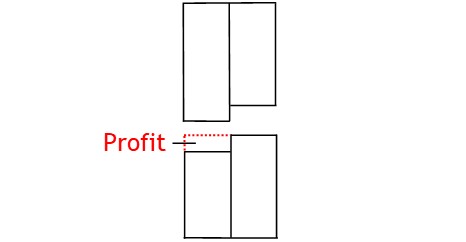

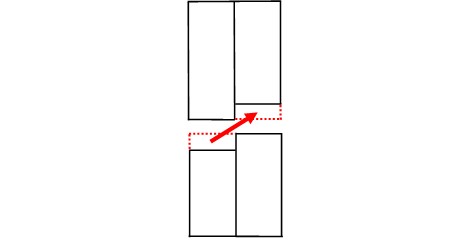

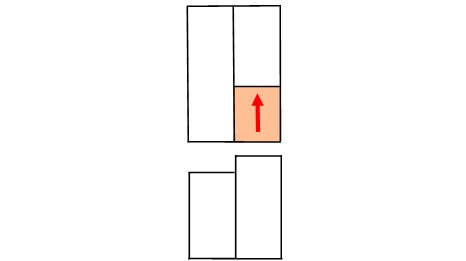

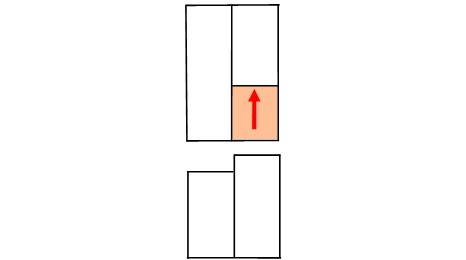

Equity changes as the relationship between assets and liabilities changes.

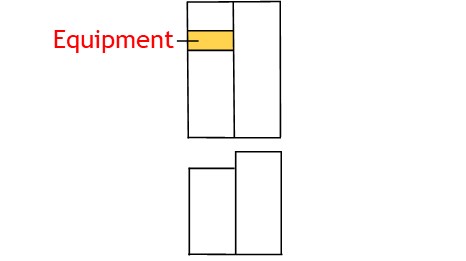

For example, the business may invest its profit in new equipment.

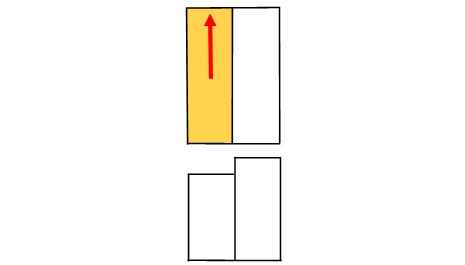

Doing this will increase overall assets.

As a result, the difference between assets and liabilities will increase.

This, in turn, will result in an increase in equity.

© R.J. Hickman 2020