Financial Statements

What are Financial Statements?

Financial statements are reports that show financial information about the business.

How They Work

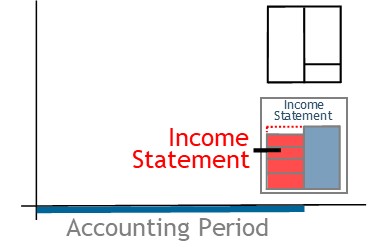

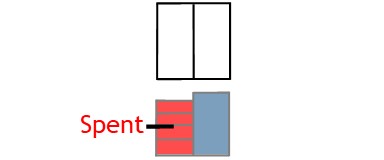

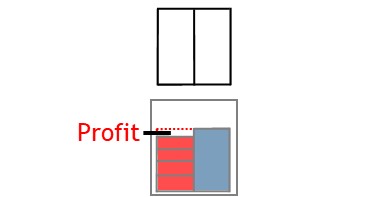

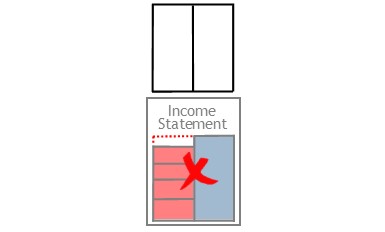

Income Statement

At the end of each accounting period, a business will prepare an income statement.

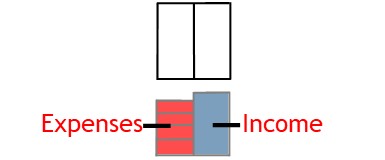

The information for the income statement comes from the income and expense accounts.

These accounts show how much the business earned from operations during the period.

Then they show how much the business spent on operating the business each month.

When complete, the income statement will show how the business performed during the period.

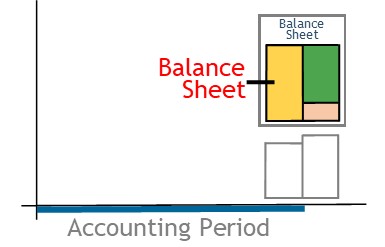

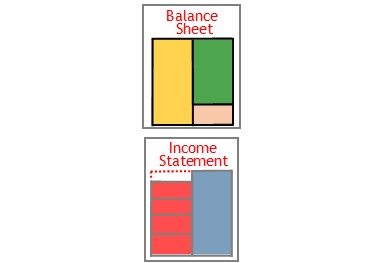

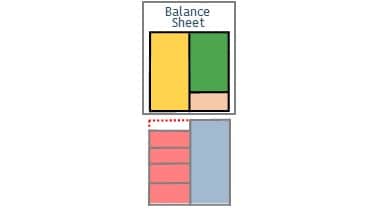

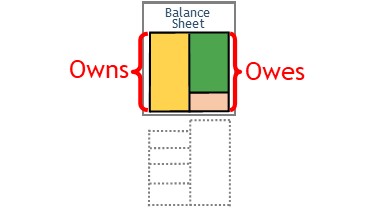

Balance Sheet

A business will also prepare a balance sheet at the end of each accounting period.

In the days of manual accounting systems, the balance sheet was used as a period-end checking tool.

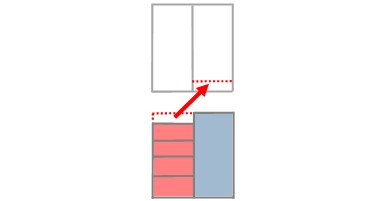

When preparing an income statement manually, it was easy to make a mistake.

To make sure the income statement was correct, you transferred profit to the retained earnings account.

After this, you prepared a balance sheet.

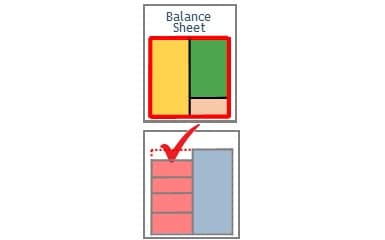

If the balance sheet balanced, it showed net profit was correct.

This check is no longer necessary.

Your computer will ensure the whole system is always in balance.

Despite this, the balance sheet is still used today.

It is used by management, investors, and lenders to show how much the business owns verses what it owes.

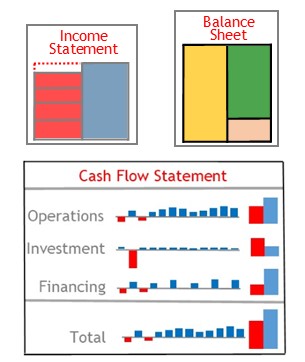

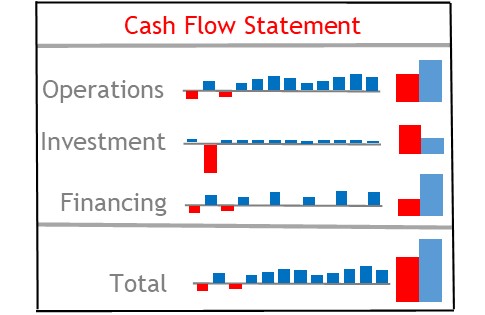

Cash Flow Statement

A business may also prepare a cash flow statement.

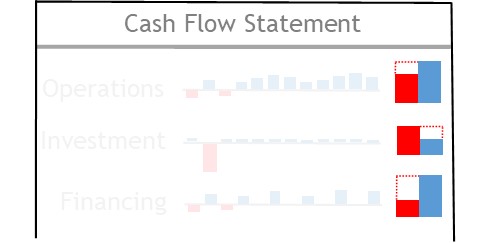

The statement is divided into three sections.

In each section, the statement shows where cash came from.

And it shows where the cash was used, or where it went.

The difference shows if cash flow was positive or negative in that area.

This will be shown for each section.

The statement will show the total of all sections.

This helps management and analysts determine if the business has sufficient funds available to meet its short term obligations.

© R.J. Hickman 2020