Income Statement

(P&L or Profit & Loss Statement)What is an Income Statement

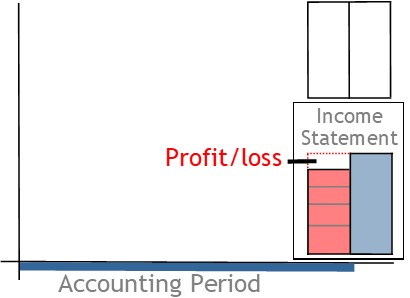

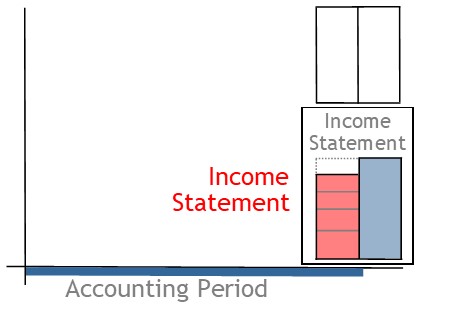

An income statement is a financial report that shows how the business performed during the accounting period.

How it Works

At the end of each accounting period, a business will prepare an income statement.

The aim of the report is to show how the business performed during the accounting period.

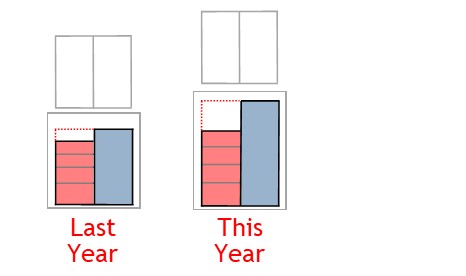

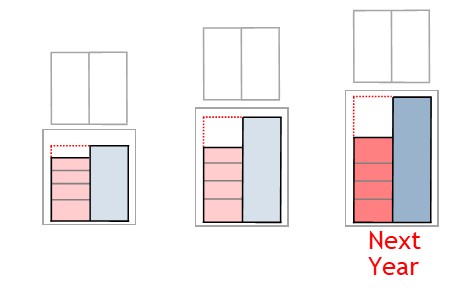

Management and analysts use the report to compare performance from one period to the next

They may be interested in revenue growth.

Or they may be interested in particular expenses.

Whatever the case, they will use the current information as a basis for predicting future trends.

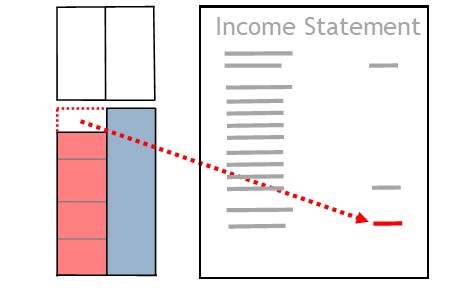

Preparing an Income Statement

Single Step Income Statement

The information for the report comes from the income and expense accounts.

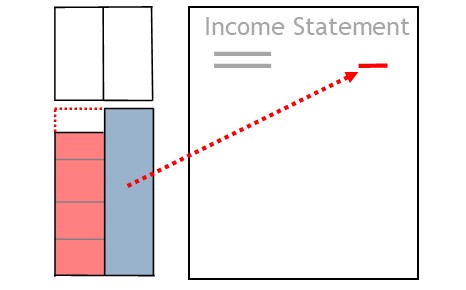

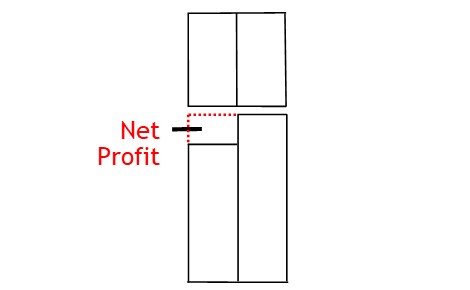

With a single step income statement, you take revenue, which is often referred to as the top line.

From this, you deduct all expenses.

This will show net profit, which is often referred to as the bottom line.

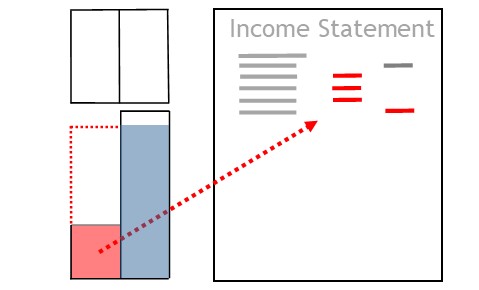

Multi Step Income Statement

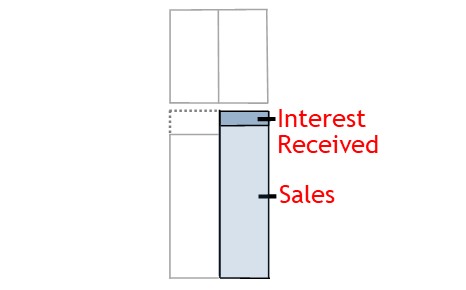

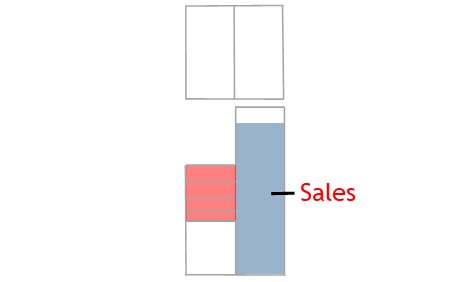

Revenue

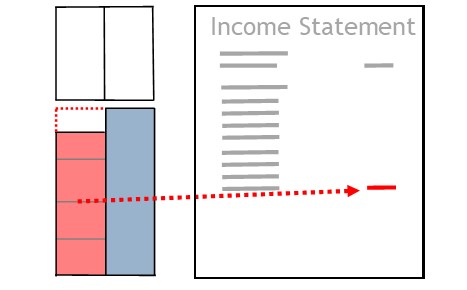

A multi-step income statement separates operating revenue from non-operating revenue.

At the top, the statement shows sales.

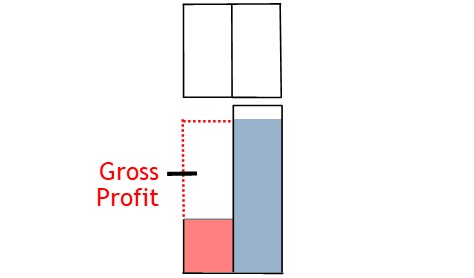

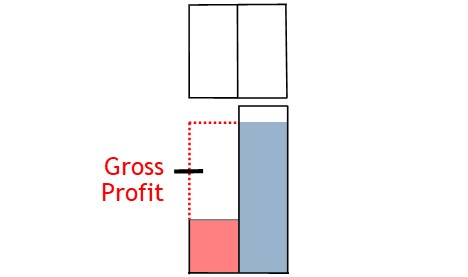

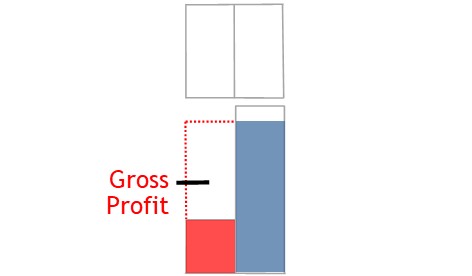

Below this, it shows the gross profit calculation.

The gross profit calculation begins with the cost of goods sold calculation (See C.O.G.S)

All the steps involved in this calculation are laid out on the statement.

Once calculated, it deducts C.O.G.S from sales to arrive at gross profit.

Again, this is shown on the income statement.

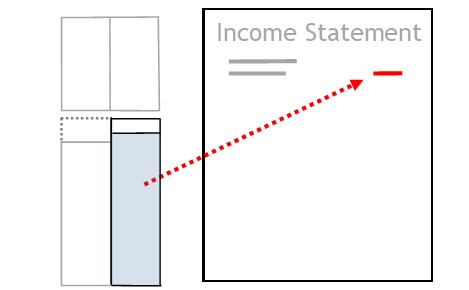

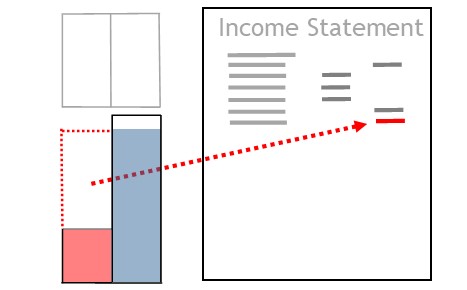

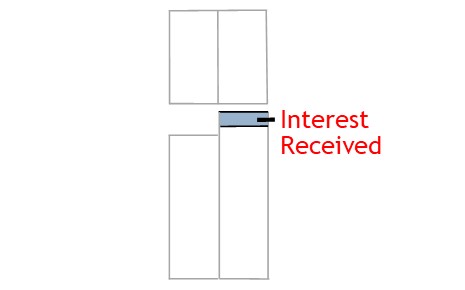

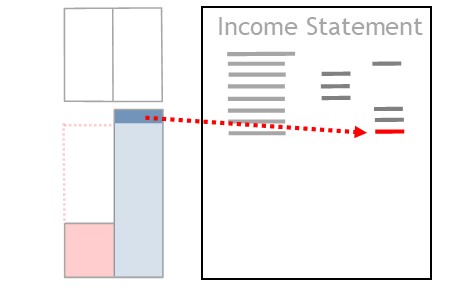

Next, the multi-step income statement shows non-operating revenue.

This includes things like interest income or the profit from the sale of an asset.

Like all other revenue items, this amount is also recorded in the top section of the income statement.

Expenes

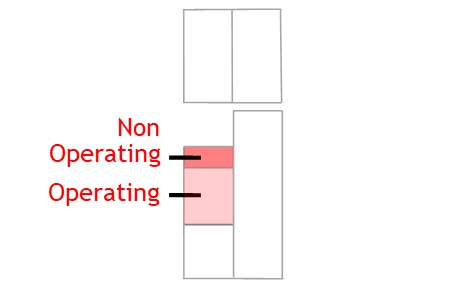

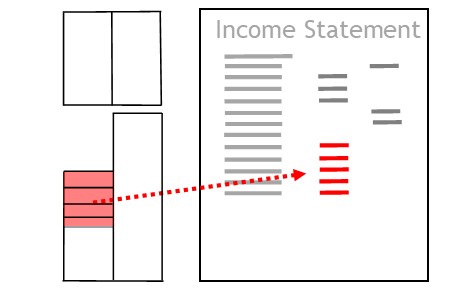

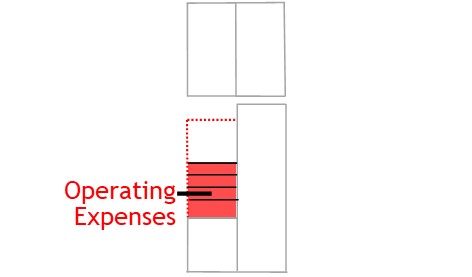

As with revenue, the multi-step income statement separates expenses into operating expenses and non-operating expenses.

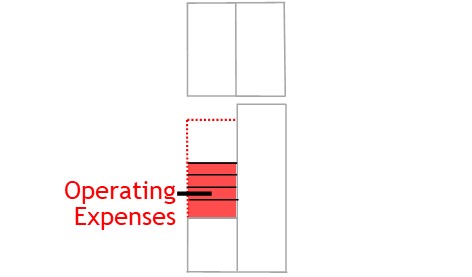

Operating Expenses

Operating expenses include things like payroll, advertising, marketing, rent, and insurance.

They are the expenses necessary to generate sales.

On the income statement, these expenses are listed under operating expenses.

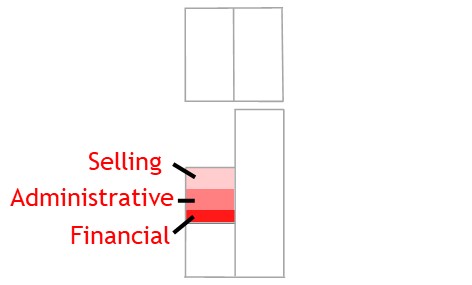

They are listed in 3 categories: selling & distribution; general & administrative; financial.

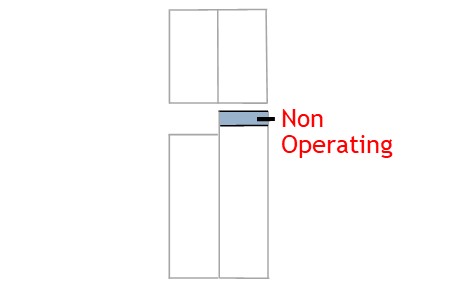

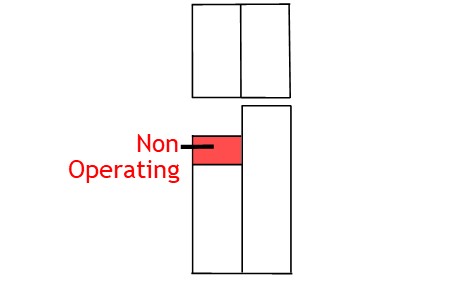

Non-operating Expenses

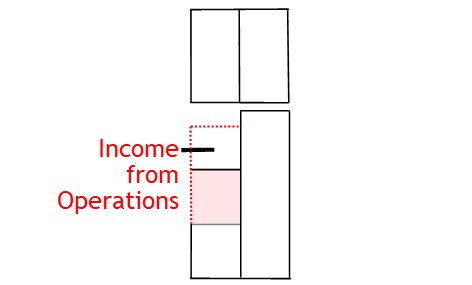

So far, the top part of the income statement showed gross profit.

After that, it showed operating expenses.

The difference between gross profit and operating expenses is known as income from operations.

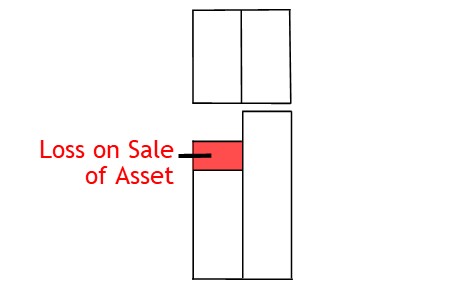

After operating expenses, the statement lists non-operating expenses.

These include things such as loss on sale of asset.

Finally, the income statement shows net profit or net income for the period.

© R.J. Hickman 2020