Income Summary

What is Income Summary?

Income summary is a clearing account used to clear out income statement accounts.

How it Works

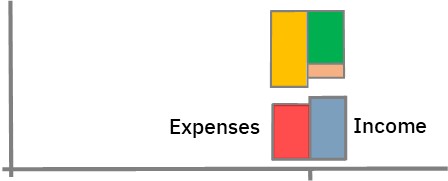

During an accounting period, you record income and expenses.

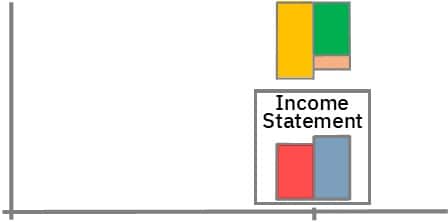

At period-end, you take that information and prepare an income statement.

Once complete, the income and expense accounts have done their job.

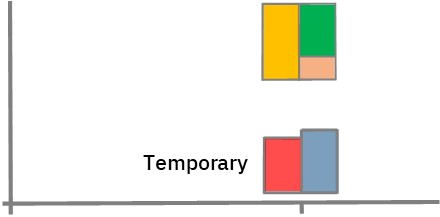

Income & expense accounts are temporary accounts

So they need to be cleared out.

This will leave them empty – ready for next period.

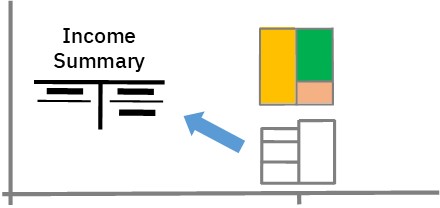

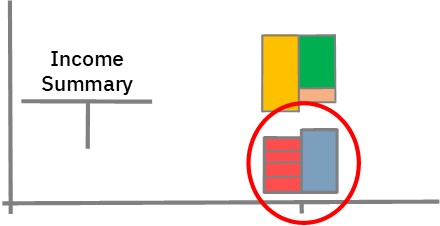

To do this, you use a clearing account known as income summary.

When complete, this account will summarize the income & expense accounts.

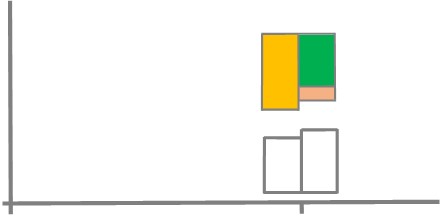

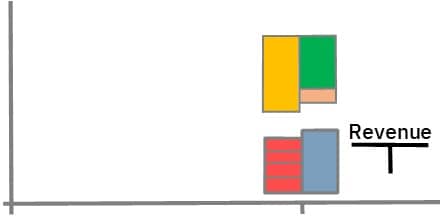

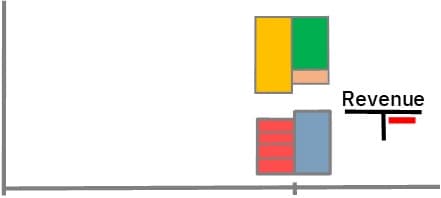

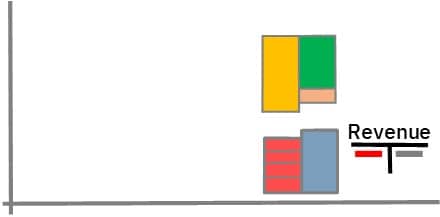

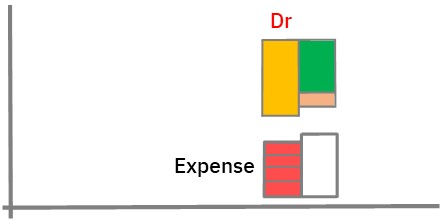

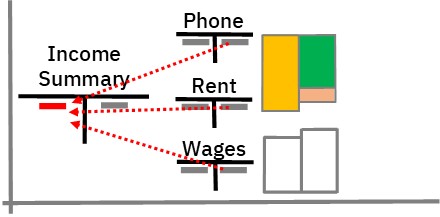

To prepare it, you begin by transferring the revenue account’s balance.

As indicated on the diagram, income accounts lie on the system’s credit side.

This means the revenue account has a credit balance

So to transfer the balance, you debit the account

Doing this brings the account’s balance to zero – thereby closing it.

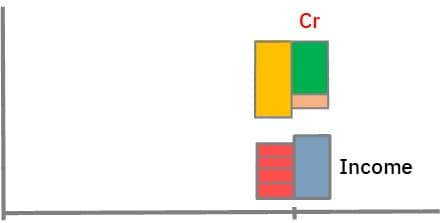

To complete the transfer, you credit income summary

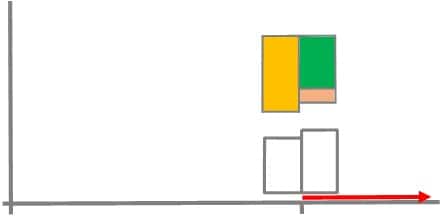

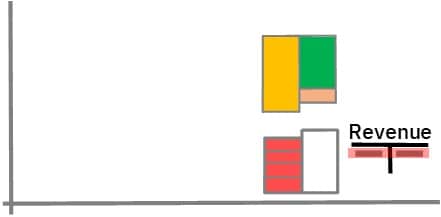

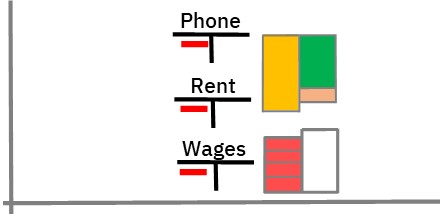

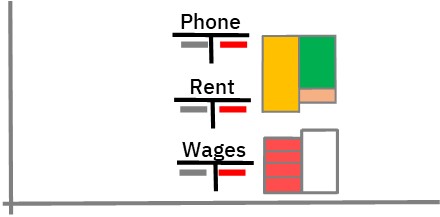

Next, you transfer expenses

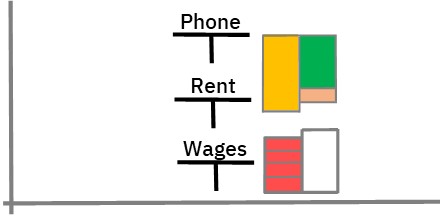

As indicated on the diagram, expense accounts lie on the system’s debit side.

This means each expense account has a debit balance.

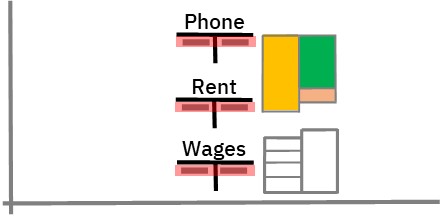

So to transfer their balance, you credit each expense account.

Doing this brings the expense account balances to zero, as well

To complete the transfer, you debit income summary with total expenses

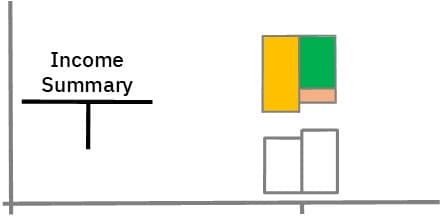

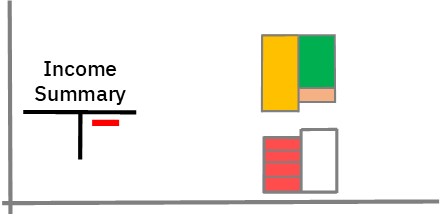

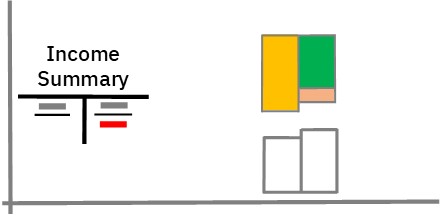

Now, you can find income summary’s balance

Once found, the balance should equal net income for the period.

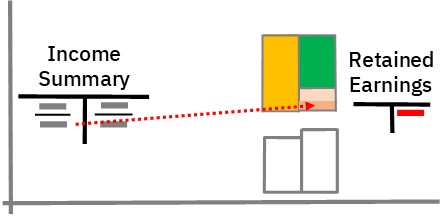

Income summary is also a temporary account and needs to be closed.

To do this, you debit the account.

Then transfer the balance to retained earnings.

© R.J. Hickman 2020