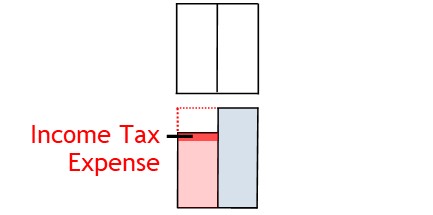

Income Tax Expense

What is Income Tax Expense?

Income tax expense is the tax expense the business recognizes, not necessarily what they will actually pay in tax for the period.

How it Works

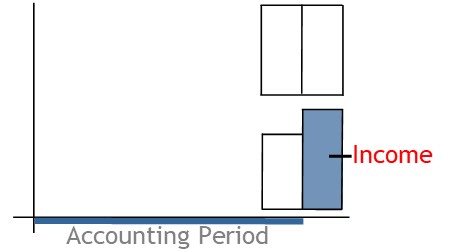

A business will earn income during an accounting period.

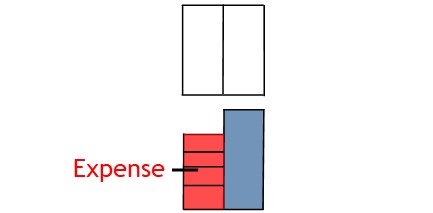

It will also incur expenses.

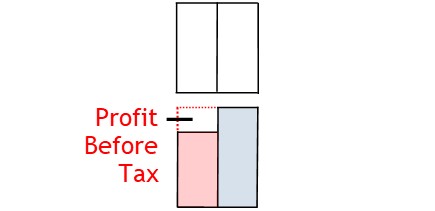

The difference will show profit before taxation.

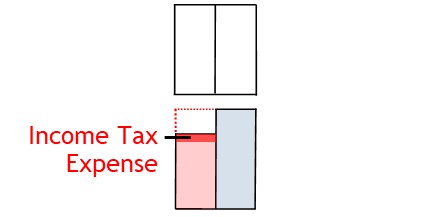

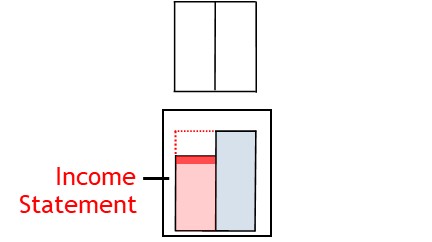

Before preparing the period-end income statement, the business will need to calculate income tax expense.

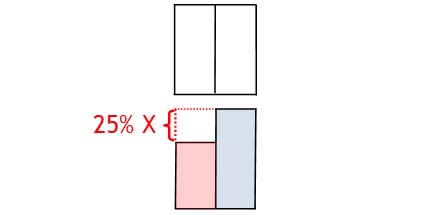

This is done by multiplying the profit before tax by a tax rate, or rates.

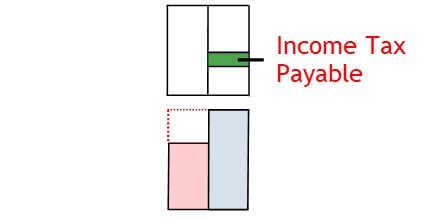

It is unlikely that income tax expense will be the same as income tax payable.

Income tax expense is only the amount of tax expense the business recognizes and shows on its period-end income statement.

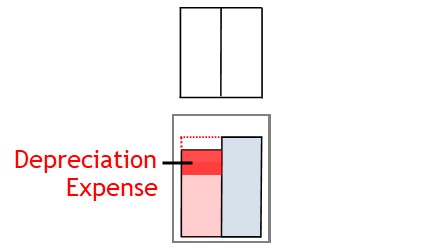

Income Tax Expense v’s Tax Payable

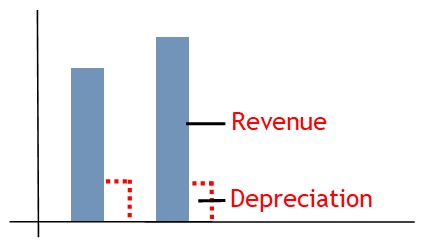

The difference between income tax expense and tax payable is often due to varying depreciation rates on assets.

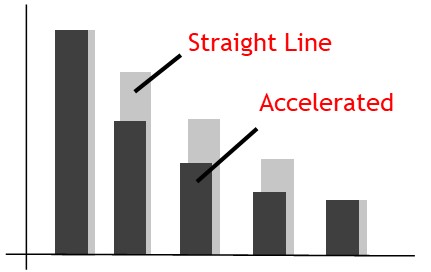

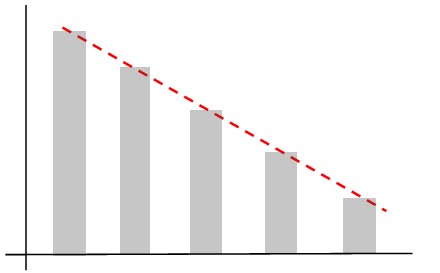

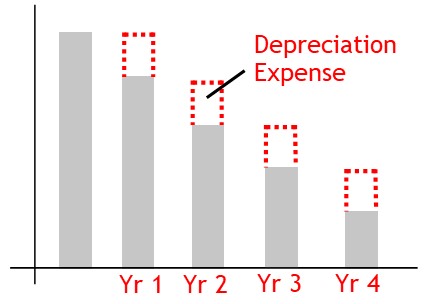

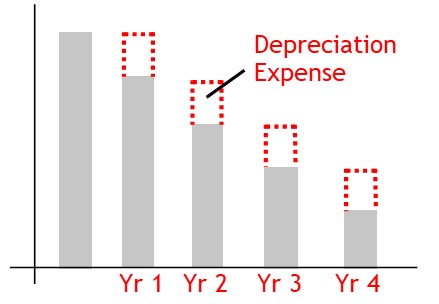

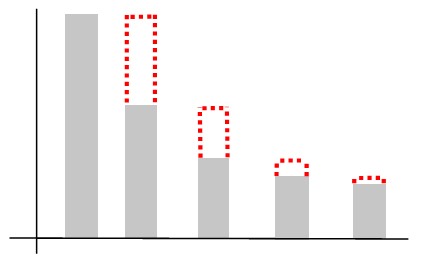

Straight Line Depreciation

For reporting purposes, the business may use the straight-line method of depreciation to depreciate assets.

This allows them to apply the matching principle to depreciation expense.

That is, depreciation expense is matched to revenue in the period that revenue was earned.

This way, the business can report the asset’s depreciation expense in the income statement in the accounting period in which it was used.

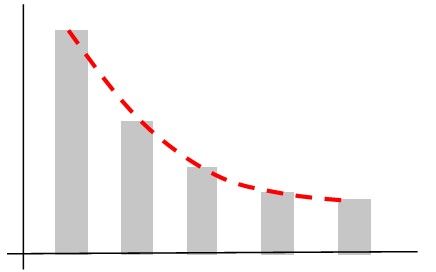

Accelerated Depreciation

When preparing the actual tax return, a business may apply an accelerated depreciation rate to its assets.

With accelerated depreciation, depreciation is higher in the short term.

This means non-cash expenses will be higher initially.

As a result, profit before tax is lower.

This, in turn, means tax payable will be lower.

© R.J. Hickman 2020