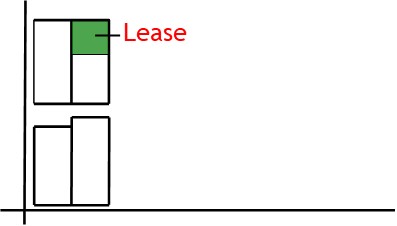

Lease

What is a Lease?

A lease is an agreement where the lessee pays to the lessor an amount of money over time for equipment etc.

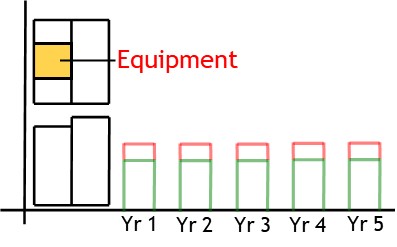

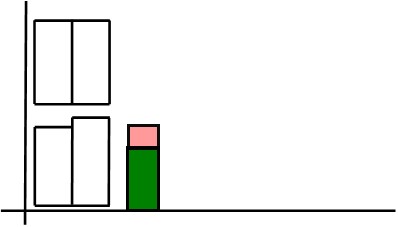

Loan Vs Lease

Loan

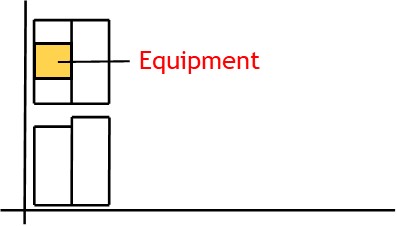

A business may need to buy a new asset, such as equipment.

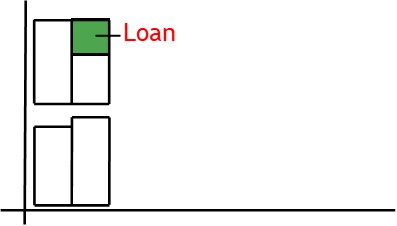

The business can buy this asset by borrowing money via a loan.

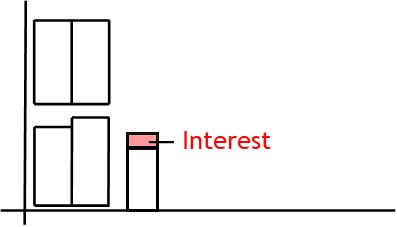

They will need to pay interest on the loan.

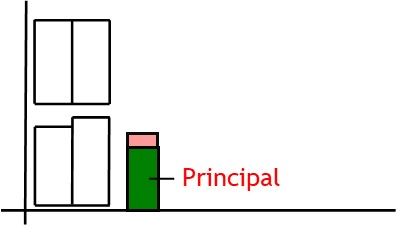

And they will also need to make principal repayments

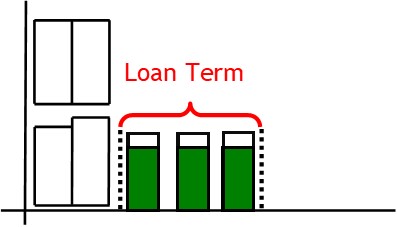

The problem with a loan is the principal must be repaid over the loan term.

This can make those payments prohibitively high.

Lease

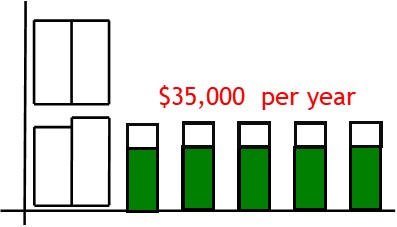

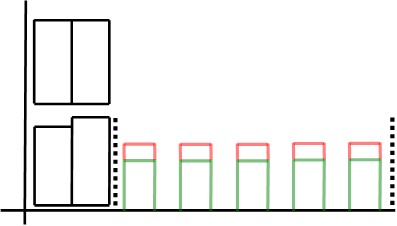

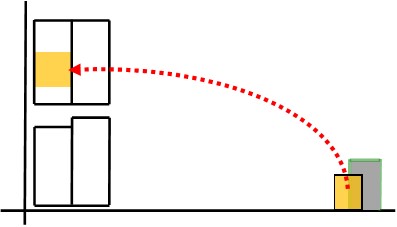

Alternatively, the business could acquire the asset with a finance lease.

Again, the business will need to pay principal and interest.

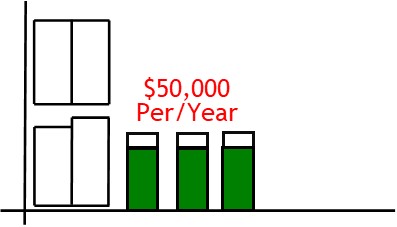

With a lease, though, the principal repayments are spread over the asset’s useful life.

Total interest will be higher with a lease.

However a lease offers lower principal payments.

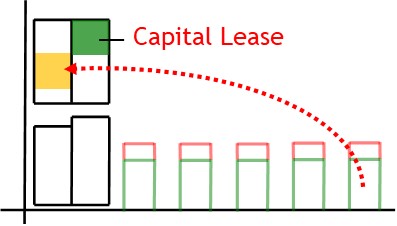

Capital Lease

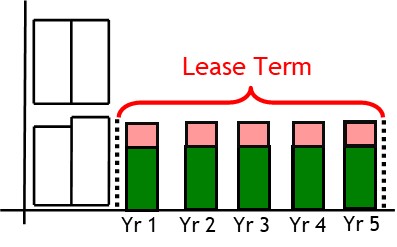

A capital lease is a lease where the lessee ends up owning the asset.

Here, the lessee makes lease payments throughout the lease term as per normal.

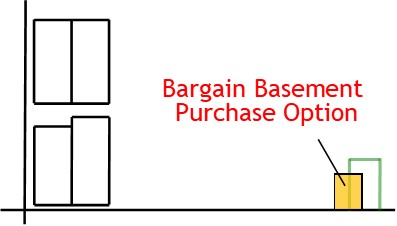

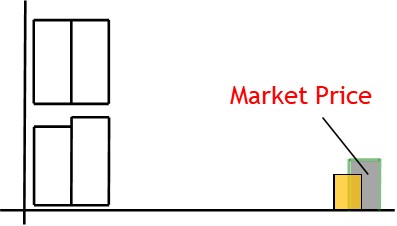

Then, at the end of the lease term, the lessor may offer a bargain basement purchase option.

This is usually priced well below market price, making it attractive for the lessee.

The lessee may then purchase the asset and end up owning it.

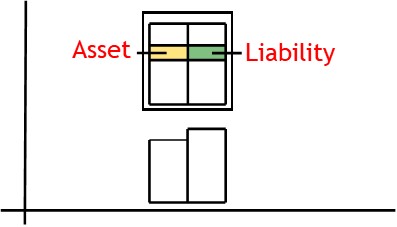

With a finance lease, both the asset and the liability need to be shown on the balance sheet.

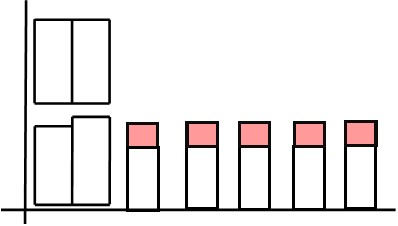

Operating Lease

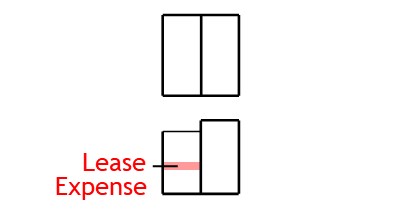

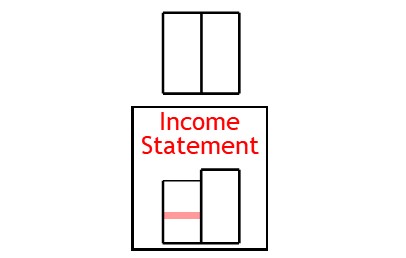

Many leases do not end up being owned by the lessee.

These leases are usually held for a much shorter time period and are treated as an expense, only.

© R.J. Hickman 2020