Prepaid Expense

What is a Prepaid Expense?

A prepaid expense is an expense you have paid in advance but is set aside as a current asset until it is used.

How it Works

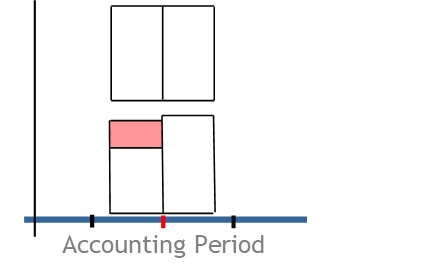

Most of a business’s expenses will be used during the current accounting period.

However, some expenses may be need to be paid in advance.

This means the expense will be paid at some point during the current period.

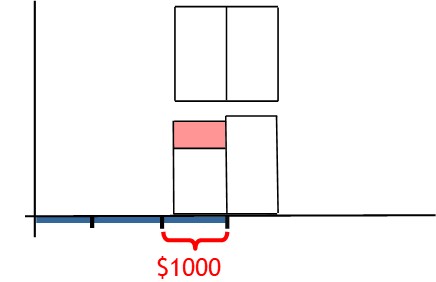

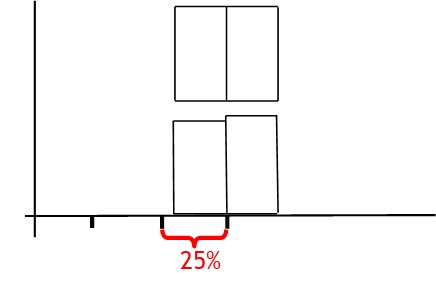

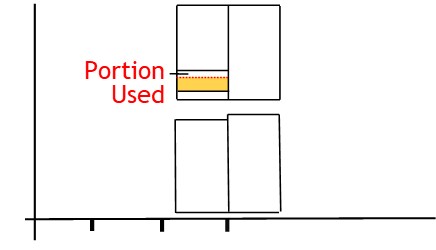

But only a portion of it will be used by period-end.

The remaining portion won’t be used until the coming period.

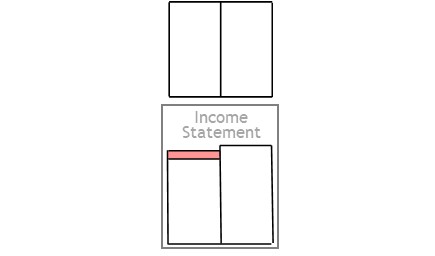

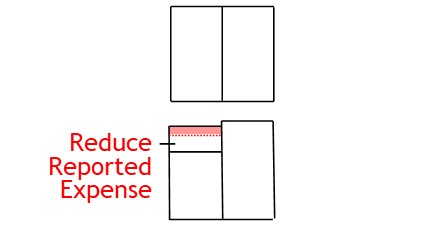

For your period-end report to be correct, it should not show the whole payment.

Instead, it should show expense used during the current period, only.

So, at period-end, you need to adjust your accounts.

Recording a Prepayment

(Using Balance Sheet Method)

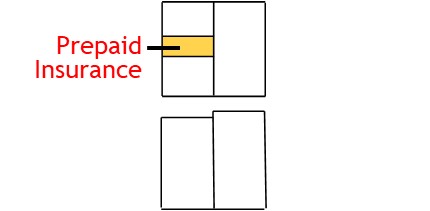

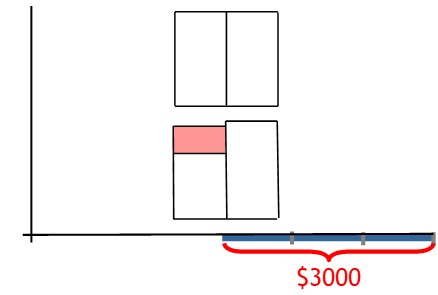

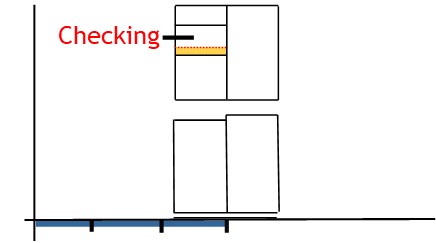

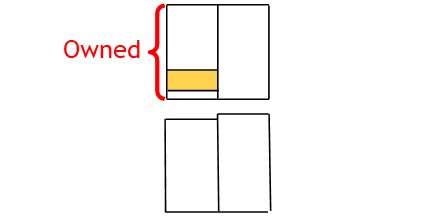

When the expense is first paid, you show that money came from the bank.

Then you record the payment in the prepaid expense account.

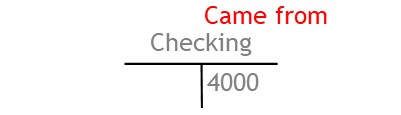

To do this, you credit the checking account.

This shows money came from the bank.

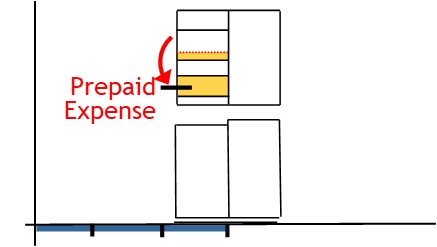

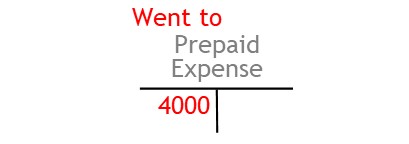

After that, you debit the prepaid expense account.

This shows you have allocated the full value of the advance payment to the prepaid account.

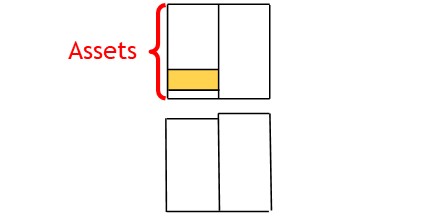

The prepaid expense account is an asset account.

Until used , the prepaid money still belongs to the business.

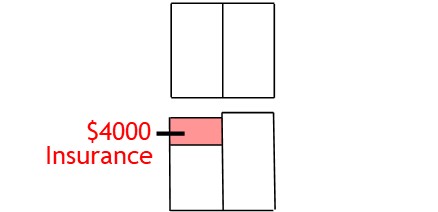

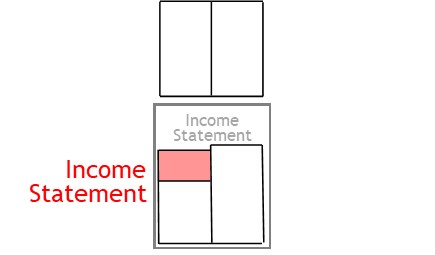

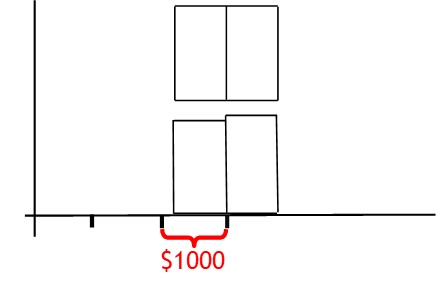

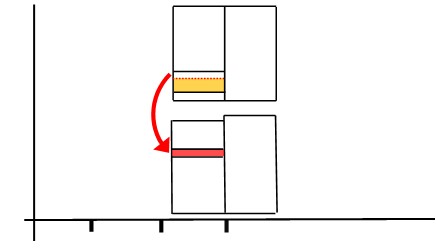

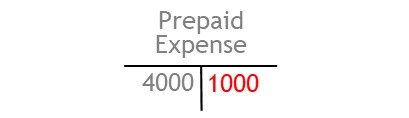

During the period, a portion of the prepaid expense will be used.

Here, you have t calculate the amount of prepaid expense used.

Once calculated, you take that value from the prepaid expense account.

Then you record the amount in the appropriate expense account.

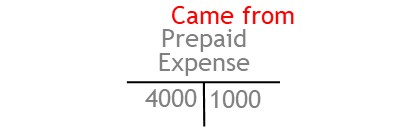

To record the transaction, you credit the prepaid expense account.

This shows you have taken a portion of the value from the prepaid expense account.

After this, you debit the appropriate expense account.

This shows the portion of the prepayment has been used for that particular expense.

© R.J. Hickman 2020