Retained Earnings

What are Retained Earnings?

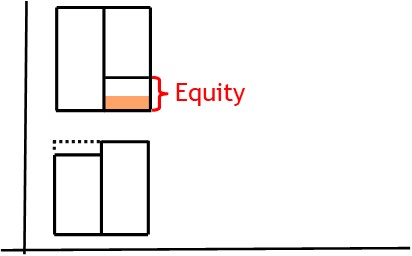

Retained earnings is an equity account, showing accumulated profits since business inception, less any dividends paid.

How it Works

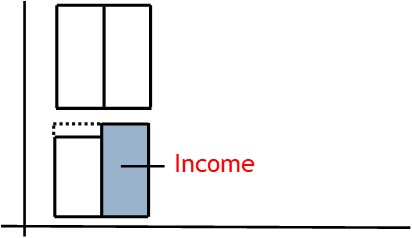

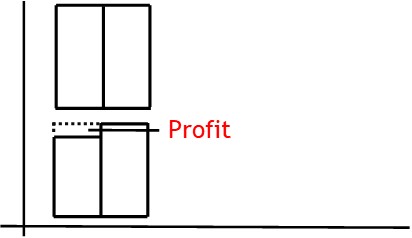

During an accounting period, a business will earn income.

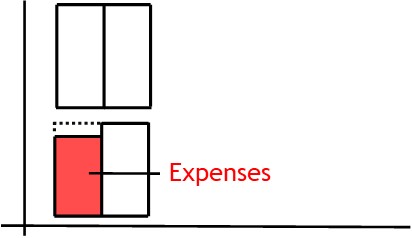

It will also incur expenses.

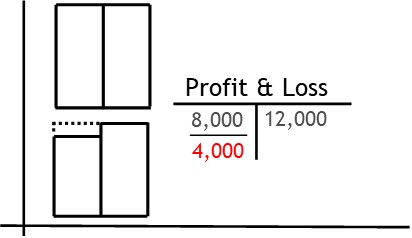

Providing income is greater than expenses, it will make a profit.

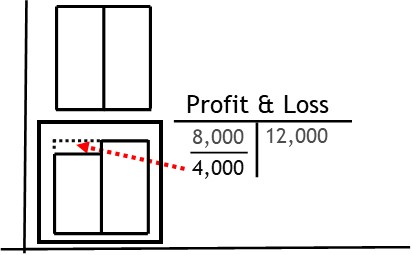

The profit is recorded in the profit and loss account.

Then it is shown in your period end reports.

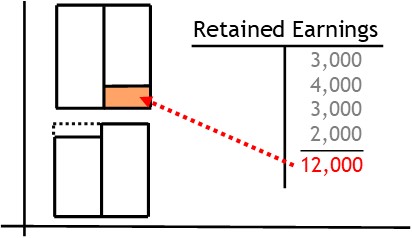

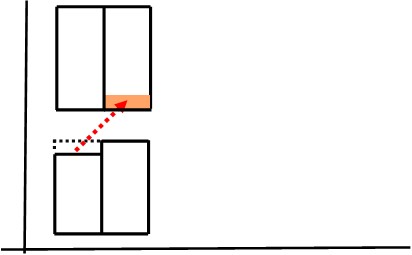

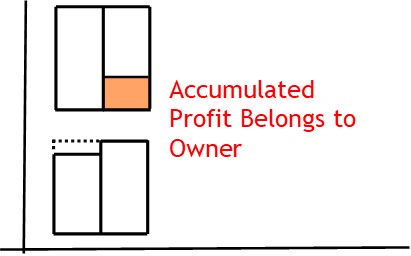

After that, it is transferred to the retained earnings account.

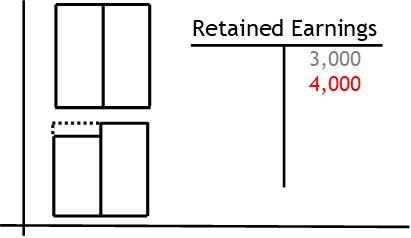

The retained earnings account is an equity account.

Equity accounts show how much money the business owes to the owner.

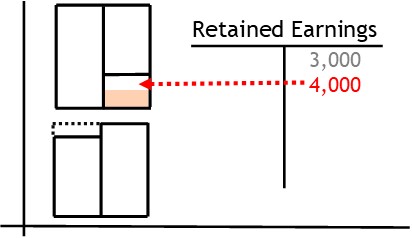

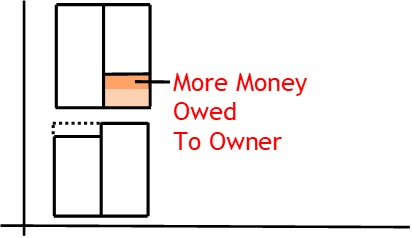

By crediting the retained earnings account, you will increase the account’s balance

This shows the owner is owed the current profit, as well.

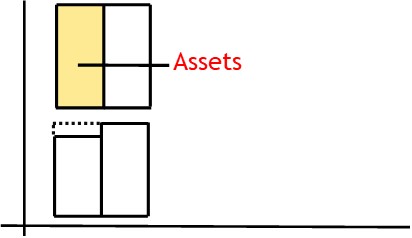

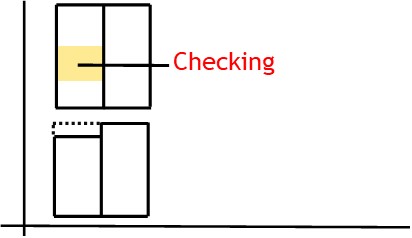

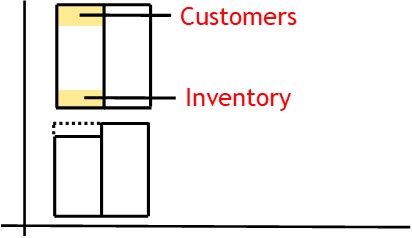

The actual retained earnings will be contained in asset accounts.

For example, retained earnings may form part of the business’s cash holdings.

Or it could form part of accounts receivable or stock.

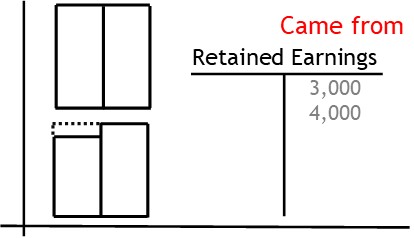

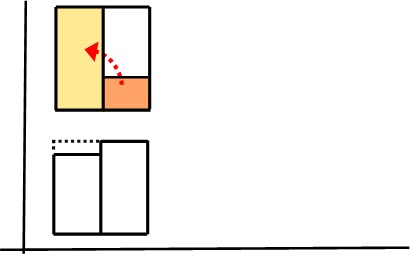

As such, the accounts need to show that some of the value held in asset accounts came from retained earnings.

To do this, you use a credit entry.

This shows money has come from retained earnings.