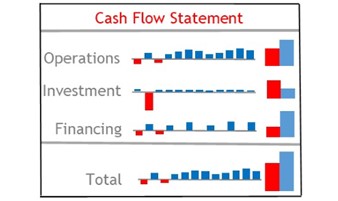

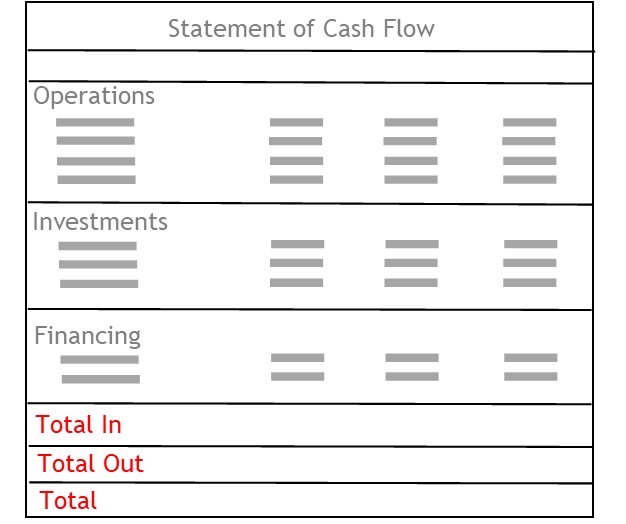

Statement of Cash Flows

What is a Statement of Cash Flows?

A cash flow statement reports where money came from during the accounting period and where it was used.

How it Works

With any business, cash continually flows into it.

At the same time, cash continually flows out of it.

Most of the time, the business should have a cash surplus.

This means it has more cash than it uses at that time.

At other times, it will have a cash deficit.

In this case, the business is using more cash than it is receiving.

The business’s management will want to monitor cash flow, closely.

If cash flow is inadequate, the business will be unable to meet its obligations

To help them monitor cash flow, management lay down a cash flow budget.

Then, at period-end, they will produce a statement of cash flows that shows the actual cash flows for the period.

This statement may include the budgeted cash flow set out at the beginning of the period.

It may also show cash flow results from previous periods.

Analysts and investors will rely upon cash flow statements to determine business’s viability.

Suppliers also rely upon the statement of cash flows to determine a business’s ability to pay what it owes.

Report Format

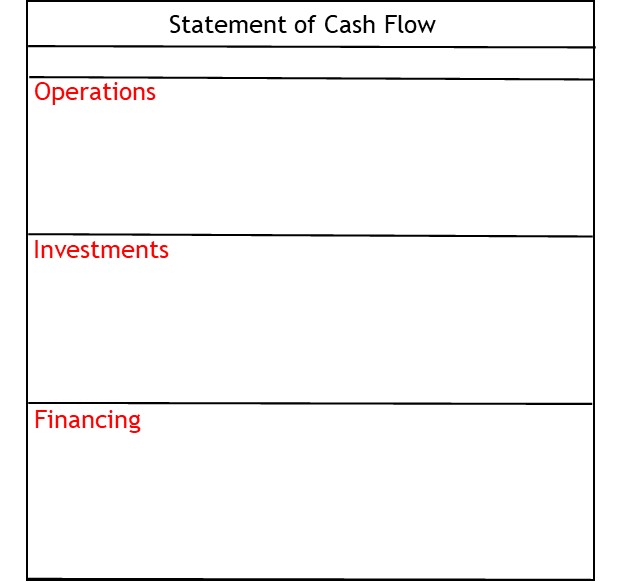

The statement of cash flows is divided into 3 sections.

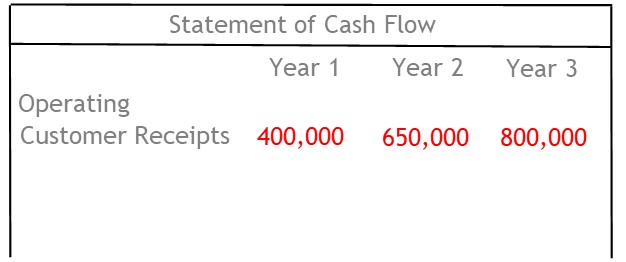

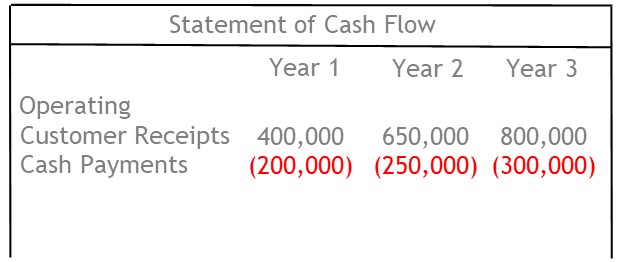

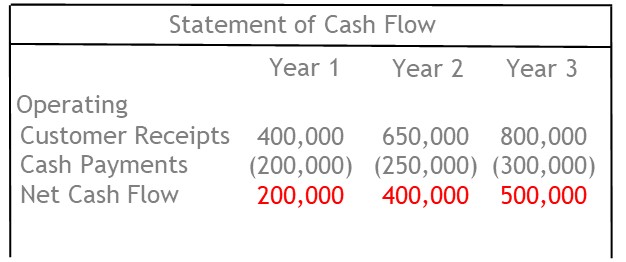

Cash Flow from Operating Activities

The operations section shows cash flow from the operations.

This section includes things like cash actually received from customers.

It also shows cash paid to suppliers and for other operating expenses.

The difference shows net cash flows from operations.

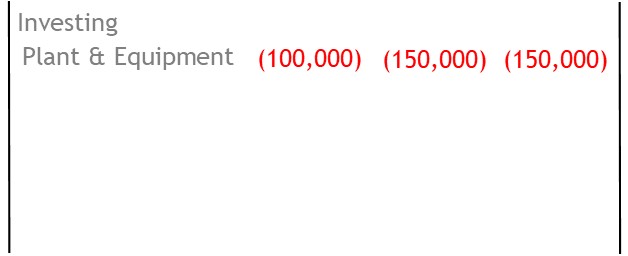

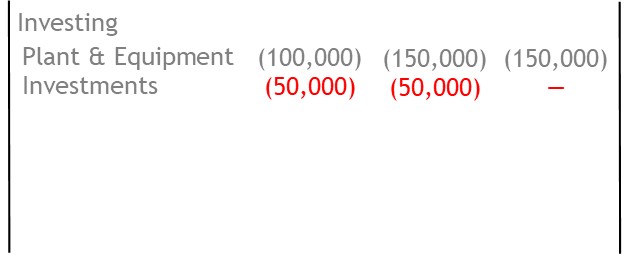

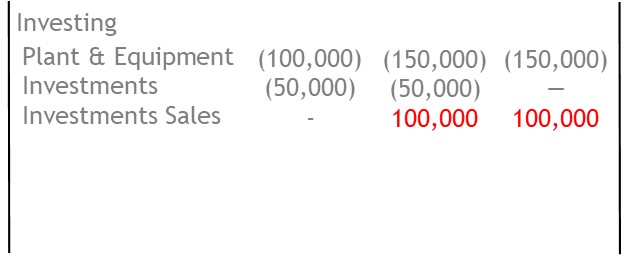

Cash Flow from Investing Activities

The investments section shows cash flows resulting from investment activities.

This section will include any outgoings as a result of buying plant

It will also show outgoings resulting from the purchase of investments.

Finally, it will show any cash receipts from the sale of investments.

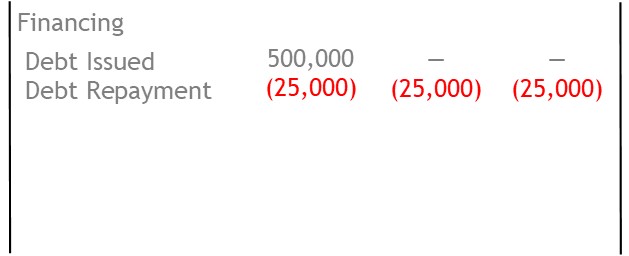

Cash Flow from Financing Activities

The financing section shows cash flows resulting from financing activities.

For example, it will show the proceeds of any borrowings from loans or bond issues.

It will also show outgoings due to any debt payments.

Total Cash Flow from All Activities

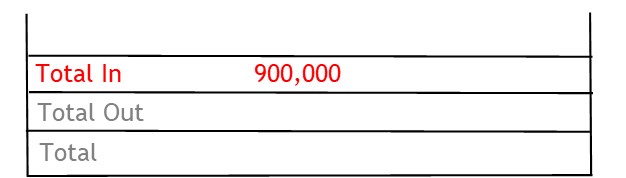

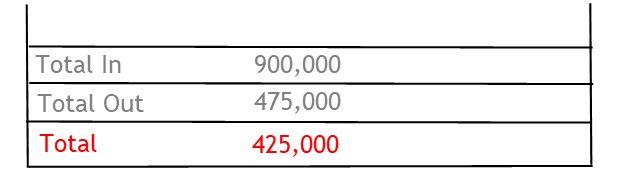

Once complete, the total columns will summarize the cash flow information.

The total in column will show all cash flowing into the business from all sources.

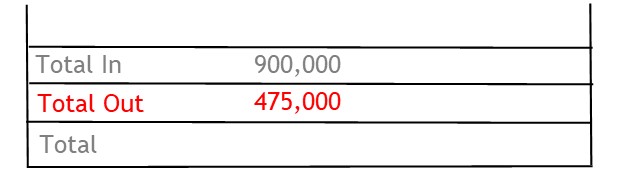

Then the total out column will show how much cash flowed out of the business.

The difference will show total cash flow for the period.

© R.J. Hickman 2020