Temporary Accounts

What are Temporary Accounts?

Temporary accounts are accounts that are closed out at the end of the accounting period.

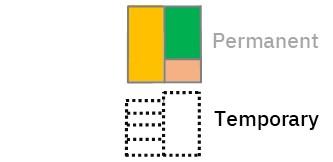

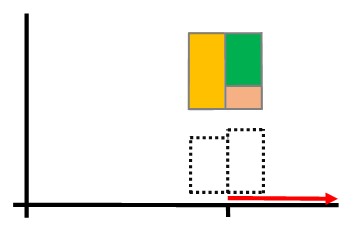

Permanent V’s

Temporary Accounts

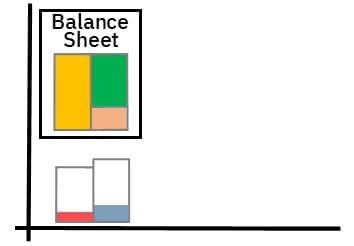

Permanent Accounts

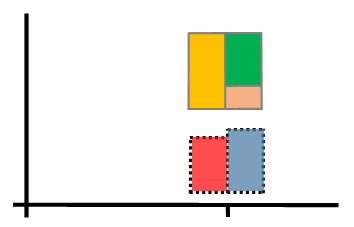

Permanent accounts are accounts that are never closed out.

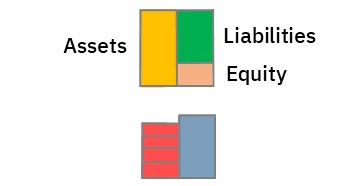

Balance sheet accounts are permanent accounts.

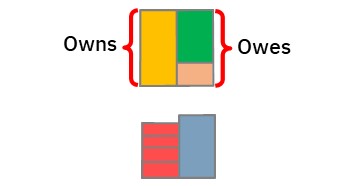

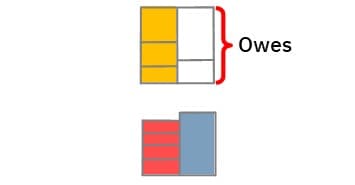

They show what a business owns and what it owes at all times

These accounts are always changing, but they never just disappear.

This is because the business will always own something and always owe something.

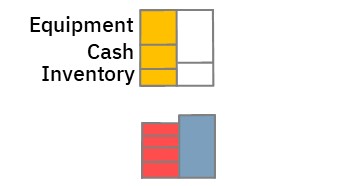

For example, it may own equipment, or money in the bank, or inventory.

At the same time, the business will usually owe money to others.

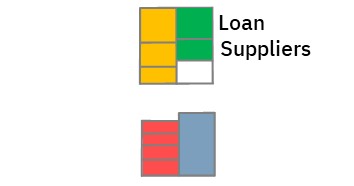

This may be a loan or money owed to trade creditors.

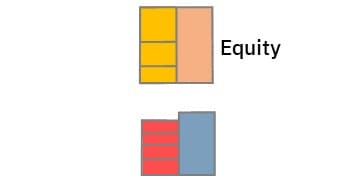

Even if the business doesn’t owe money to others, it will owe the value of any assets help to the owners or shareholders

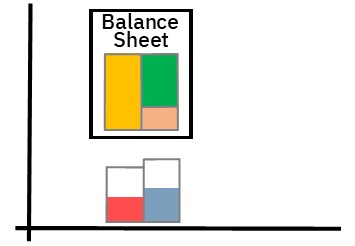

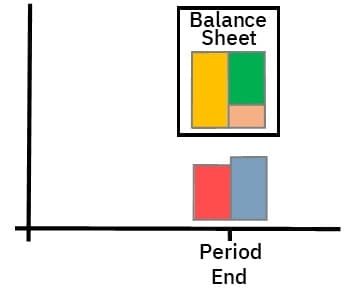

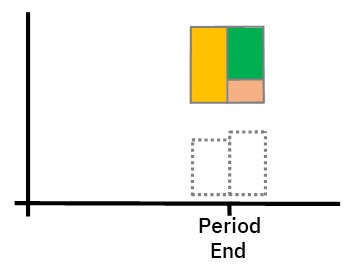

You can take the information from these accounts and create a balance sheet at any time.

This could be at the beginning of a period.

It could be half way through the period.

Or it could be at the the end of the period

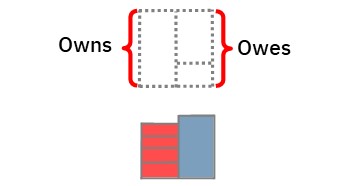

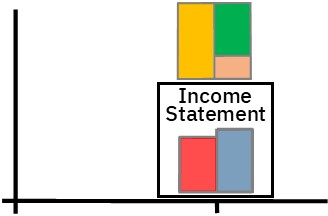

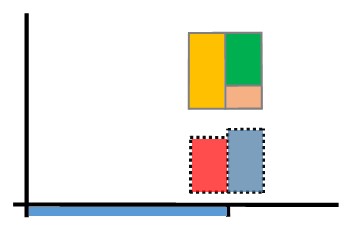

Temporary Accounts

Temporary accounts are different.

They are closed out at the end of each period.

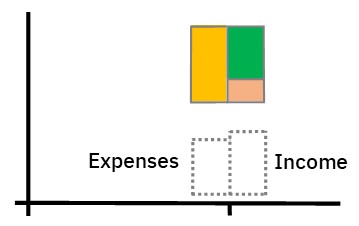

Income & expense accounts are temporary accounts.

Their purpose is to collect trading information for the current period, only.

They start off empty at the beginning of the period.

Then they’re updated along the way.

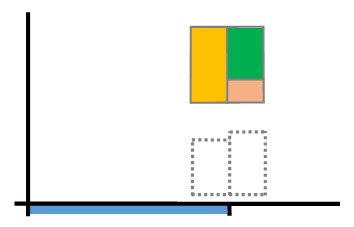

And at the end of the period, you take this information and create an income statement.

Once done, the income & expense accounts have done their job.

So you close them out by bringing their balance to zero.

By doing this, you leave them empty, ready for the next period.

This is why they are known as temporary accounts

The information they contain only exists for the duration of the period

© R.J. Hickman 2020