Treasury Stock

What is Treasury Stock?

When a company buys back some of its own shares, the stock is known as treasury stock.

How it Works

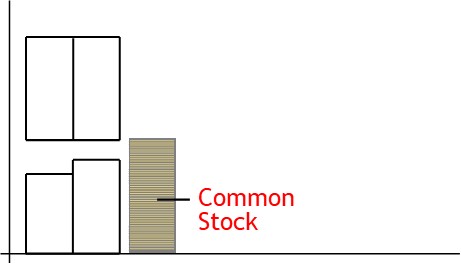

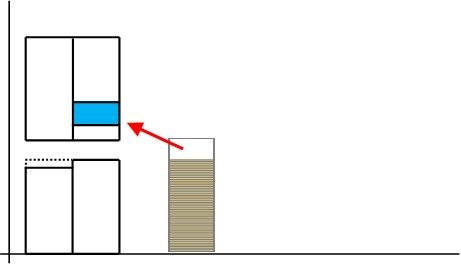

One way for a company to raise money is by way of a share issue.

This means the company will sell a certain number of shares to investors.

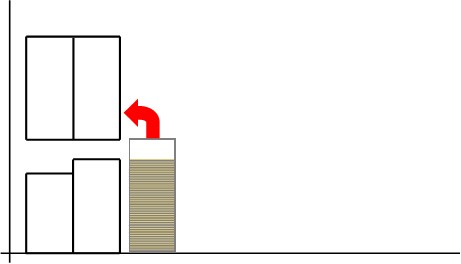

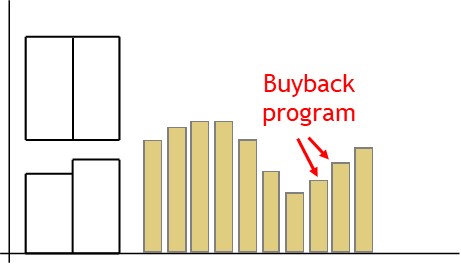

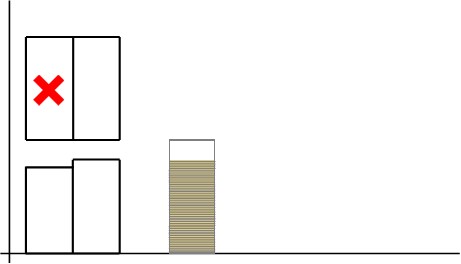

There are occasions when a company will buy back some of its own shares from investors.

The company may do this if its shares have been heavily beaten down in the market place.

By buying back shares, the company reduces the supply of shares available in the market place and prices recover.

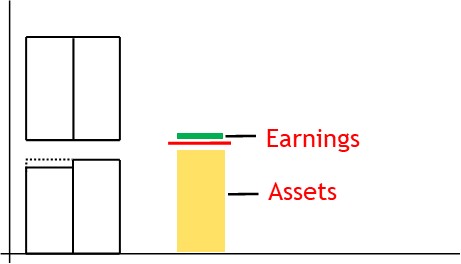

They may also buy back shares to improve metrics, such as the earnings/assets ratio.

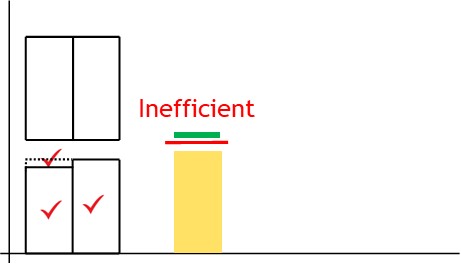

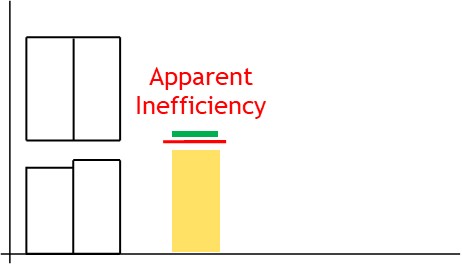

If a business has many assets but achieves low earnings, the earnings/assets ratio is seen as inefficient.

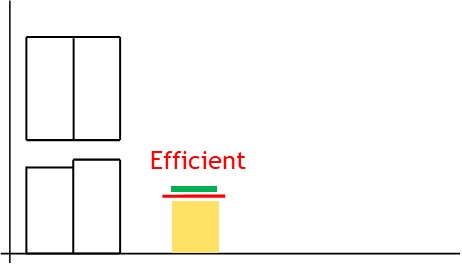

It is better that the business achieves a higher earnings to assets ratio.

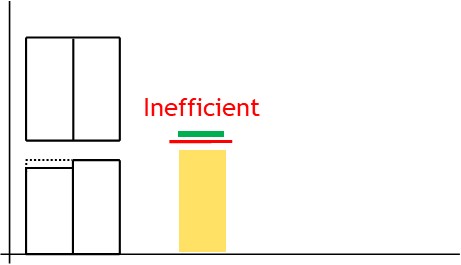

Sometimes, however, this ratio can be poor due to factors unrelated to actual business performance.

In-other-words, the business is operating at maximum efficiency but the earnings/asset ratio is inefficient.

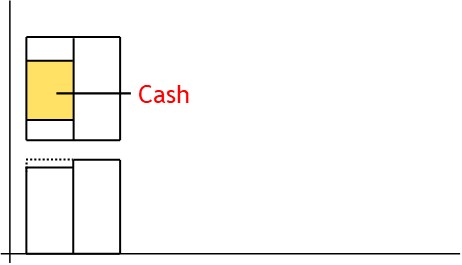

This could happen if the business is holding too much cash.

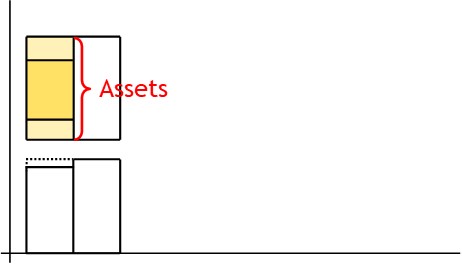

Cash at the bank is an asset of the company.

Holding too much cash inflates total asset value.

This, in turn, throws the earnings/asset ratio out.

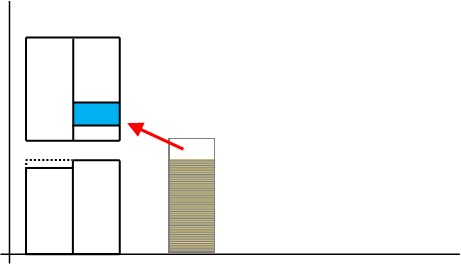

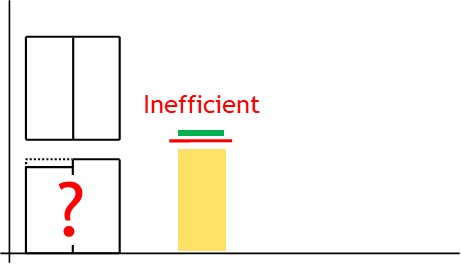

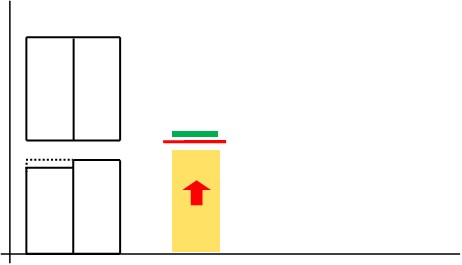

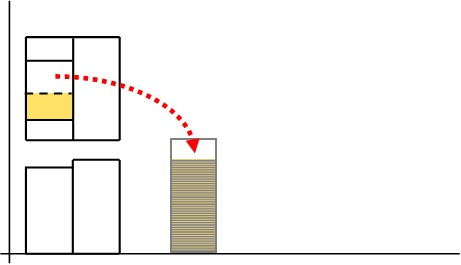

The company can alleviate this situation by using some of the cash held in the bank to buy back shares.

This will reduce total assets held by the company and bring the earnings/asset ratio into kilter.

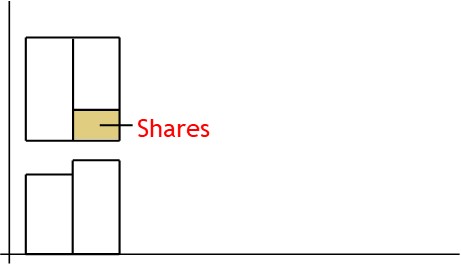

Repurchased shares are something the business owns, but they are not held as an asset.

Instead, they are held in a contra equity account.

© R.J. Hickman 2020