Trial Balance

Trial Balance

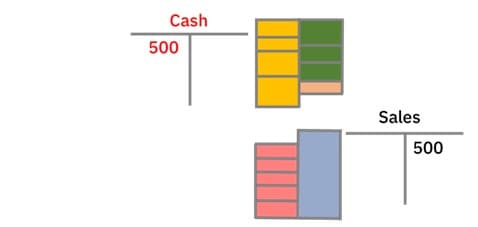

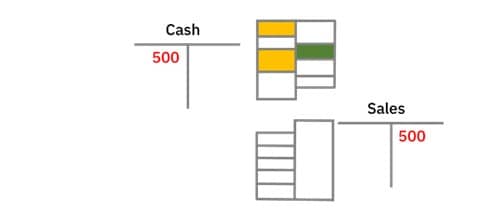

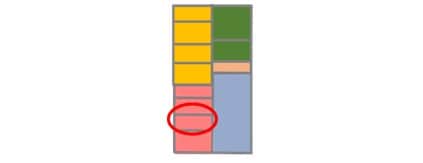

During the month, you record transactions in accounts.

Each transaction will actually appear in two accounts

One side of the transaction will appear in a general account, such as a sales account

And a duplicate record of the transaction will appear in either the cash account or one of two control accounts

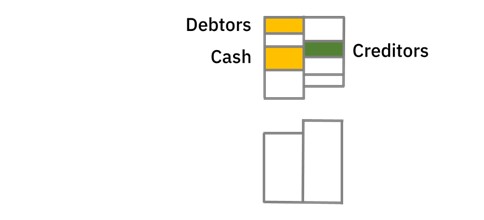

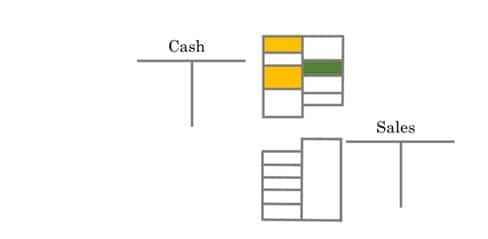

This means that a record of each & every transactions will appear in the cash account or a control account

If, after checking, the transactions in these accounts prove to be correct, then the duplicate transactions shown in the other accounts should be correct, as well.

With computerized accounting, this will always be the case.

For every credit entry, the computer will ensure there is a corresponding debit entry.

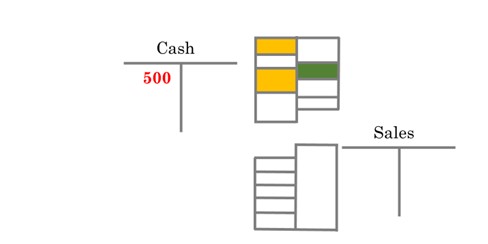

This was not the case in the days of manual accounting, though.

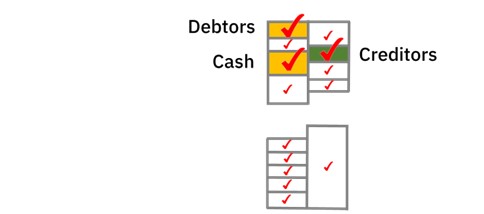

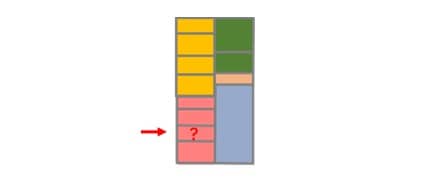

The transaction shown in the control account may have been correct.

But there was no guarantee the other side was actually a duplicate of that transaction.

To make sure there were no such errors, you prepared a trial balance.

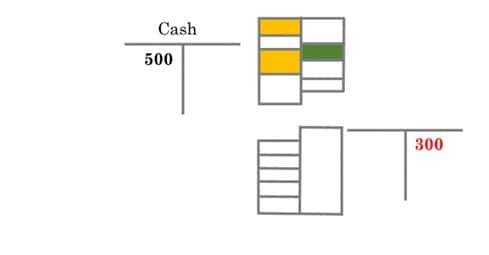

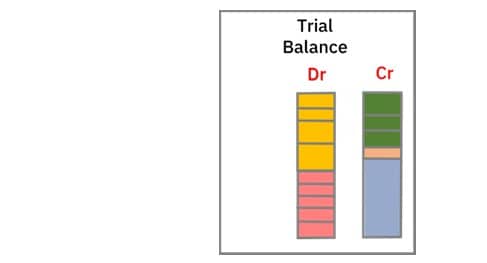

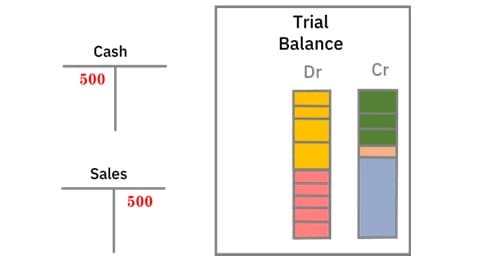

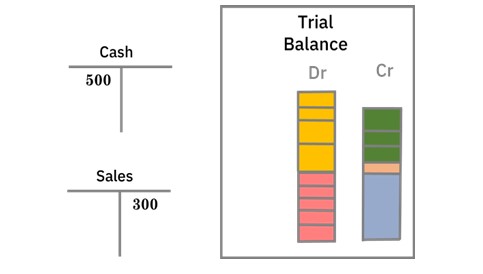

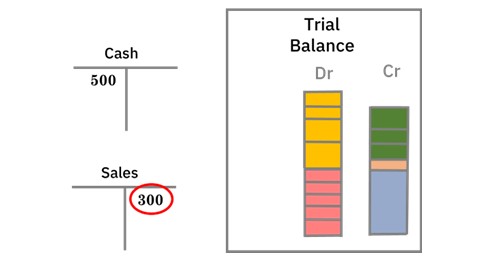

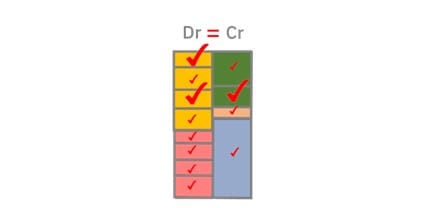

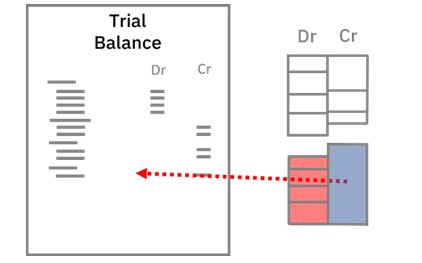

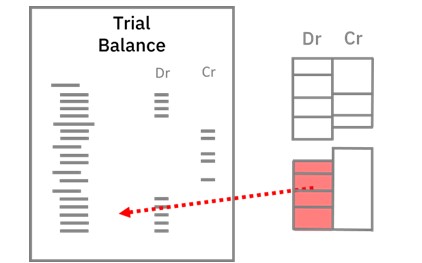

A trial balance lists the balance of every account in the general ledger.

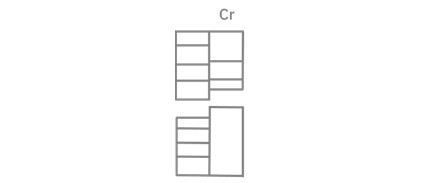

This list is divided into accounts that have a credit balance and those that have a debit balance.

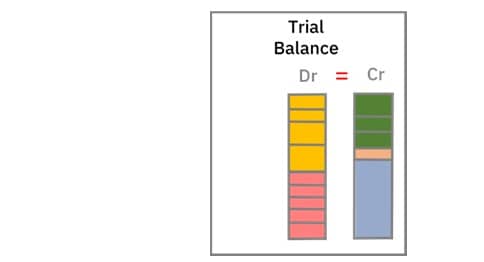

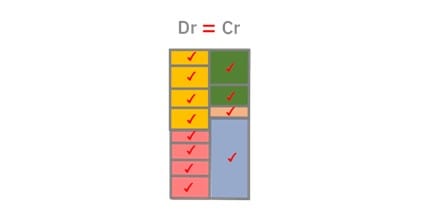

The purpose of the two lists is so you can make sure total credits equals total debits.

The reason you do this is because for every debit entry, there should be a corresponding credit entry.

So total debits should equal total credits

If this proves to be the case, then it means all of your entries were correct.

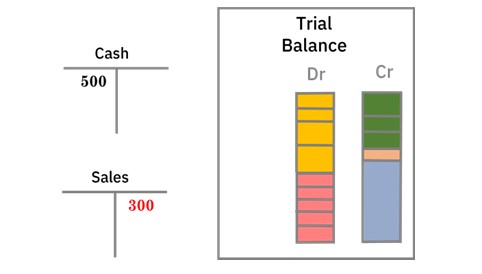

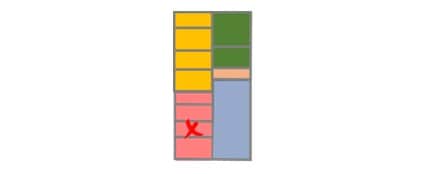

However, when recording transactions manually, it was easy to make a mistake.

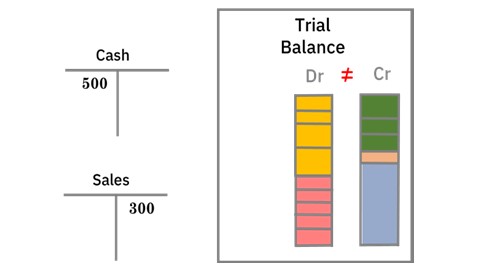

Had you made a mistake, then total debits would not equal total credits.

This meant your trial balance wouldn’t balance.

Should this be the case, you needed to go through your records to find and correct the error.

How the Trial Balance is Used Today

With computerized accounting, the trial balance is no longer as necessary as it once was.

However, errors are still possible.

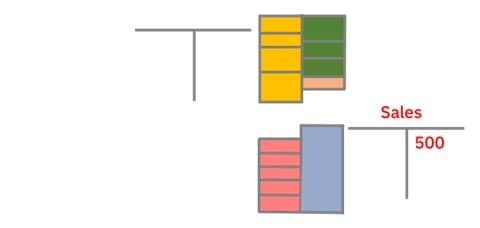

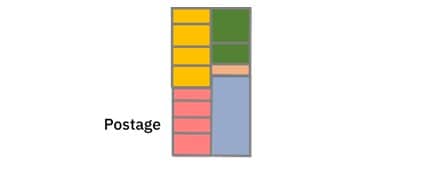

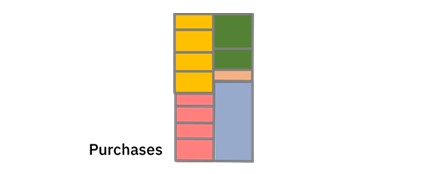

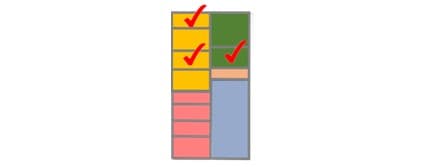

For example, you may record a transaction in the postage account.

When it should have been recorded in the purchases account.

In this case, the control accounts will still be correct.

The system will also balance.

Yet there is still an error in your records.

The only way to find this type of error is to run your eye over the trial balance and try to spot any kind of abnormality in the records

How to Prepare a Trial Balance

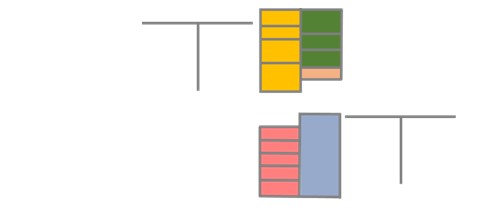

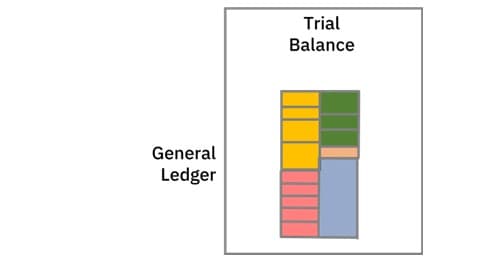

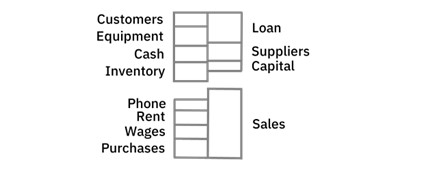

All the accounts in your accounting system form what is known as the general ledger

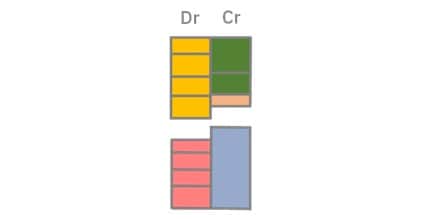

Each account has a balance.

Some accounts balance on the credit side.

Others balance on the debit side.

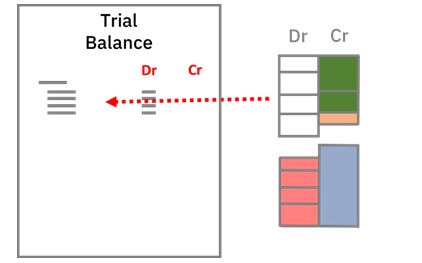

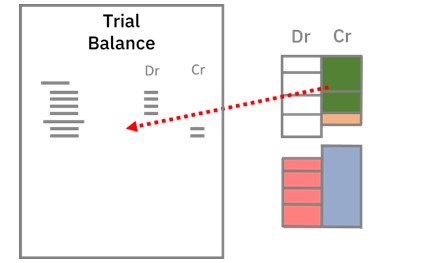

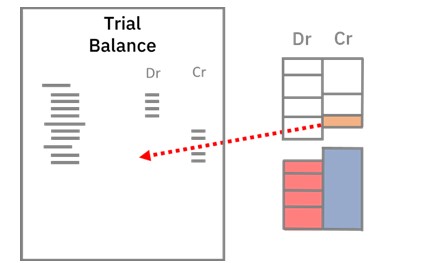

You need to find e balance of each account.

Then list these balances in a trial balance—in either a debit column or a credit column.

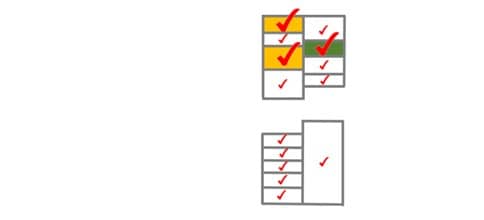

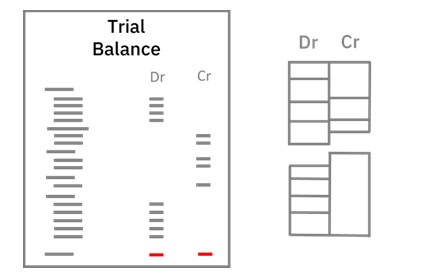

When doing this, you begin with asset accounts.

Then you record liability accounts.

Then equity accounts

income accounts

and finally, expense accounts

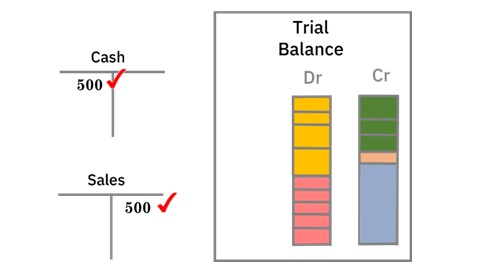

Once complete, you find the total of each column

If equal, it shows trial balance is balanced.