Units of Production Method of Depreciation

What is the Units of Production Method of Depreciation?

Units of production method of depreciation is a depreciation method where you depreciate an asset according to its usage—not it’s age.

How it Works

Most businesses own assets such as equipment, furniture, cars etc.

These assets will lose value over time.

This loss of value is known as depreciation.

Usually, an asset’s depreciation is a function of time.

In other words, you depreciate the asset based on its age.

Sometimes, though, a company will want to depreciate an asset accurately.

In other words, the company may want to match depreciation rates to production levels along the way.

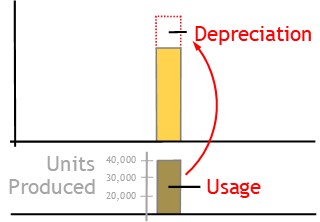

In these cases, the company may want to depreciate the asset based upon its actual usage.

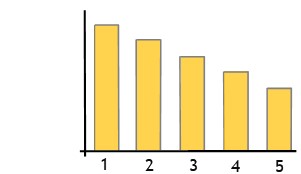

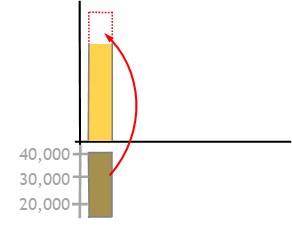

For example, suppose the factory uses the conveyor belt to produce a large number of units in the first year.

The company may want to show that this accelerated the asset’s loss of value, initially.

At other times, the company may not use the asset as much.

In this case, the depreciation rate will be lower.

Calculating Depreciation Rate

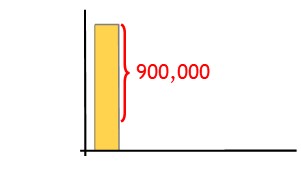

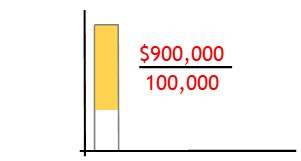

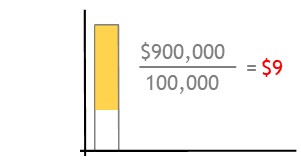

To calculate the depreciation rate, you begin by estimating how many units are likely to be produced over the asset’s useful life.

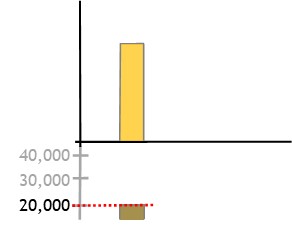

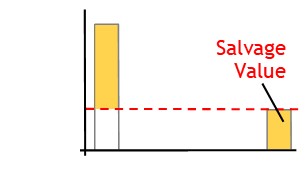

Next, you find the asset’s depreciable cost.

To do this, you deduct the asset’s salvage value from the original cost.

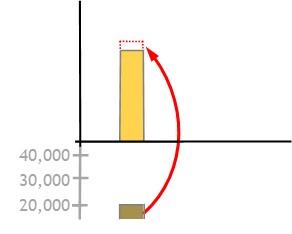

Once calculated, you divide depreciable cost by expected unit output.

This will show expected cost per unit of output.

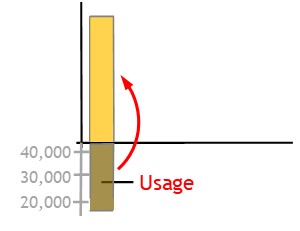

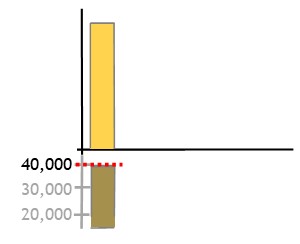

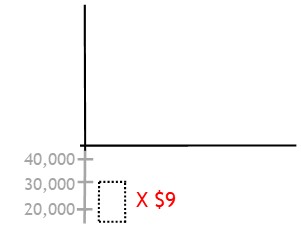

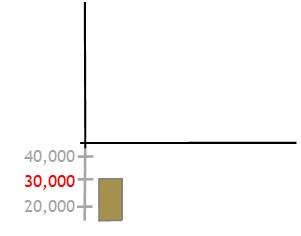

Each year, you apply this rate to the asset’s usage.

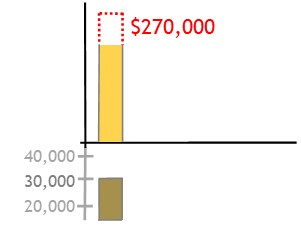

For example, suppose the company produces 30,000 units during a financial period.

You multiply this by the unit cost.

This becomes the depreciation amount for that year.