Work In Process

What is a Work In Process Account?

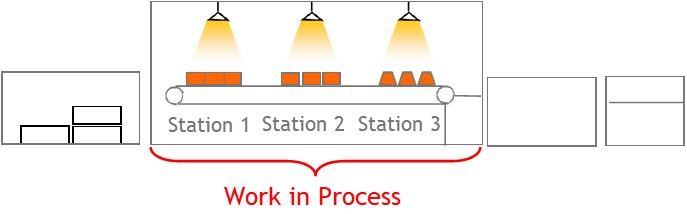

The work in process account is an asset account that tracks raw material costs, direct labor, and manufacturing overheads in the processing area of a factory.

.

How it Works

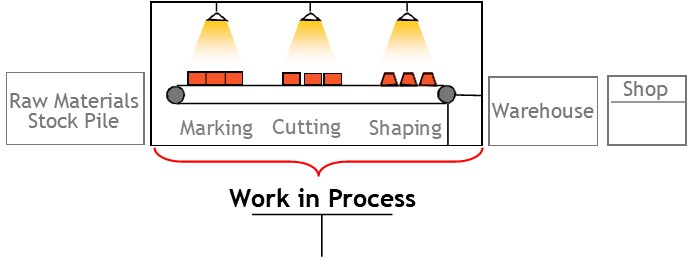

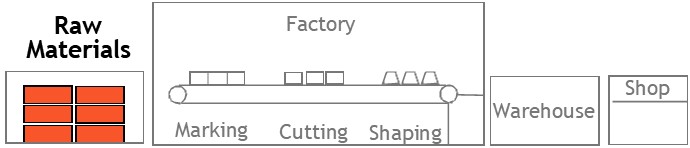

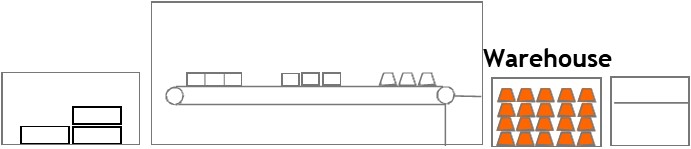

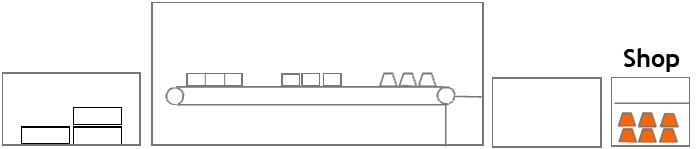

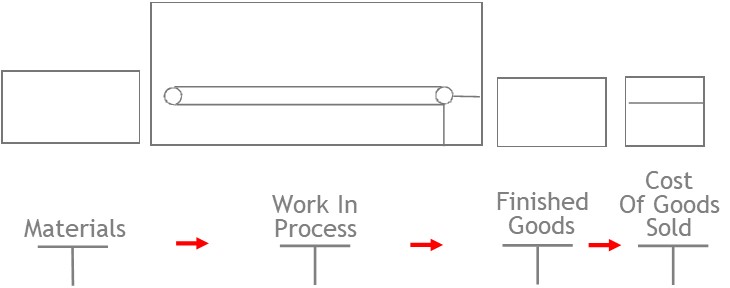

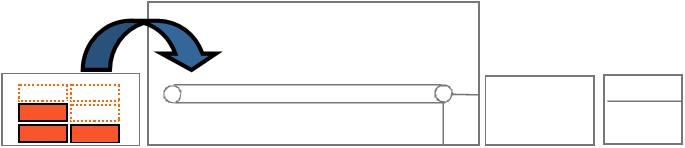

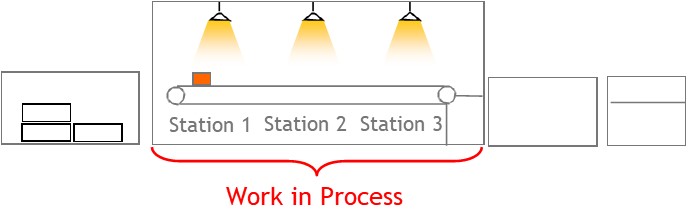

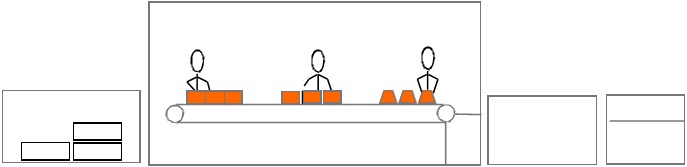

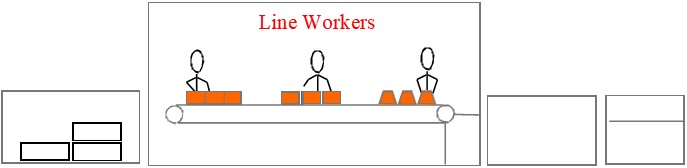

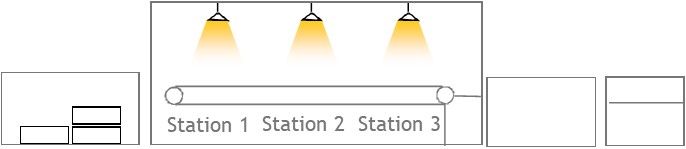

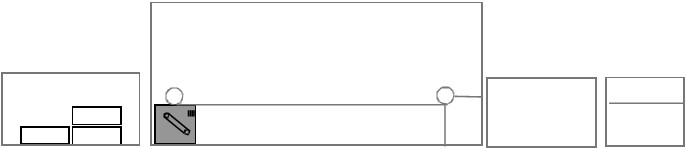

The manufacturing process starts with the stockpiling of raw materials.

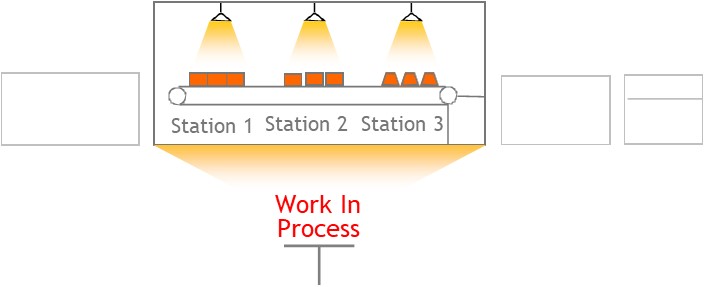

From here, the raw materials are taken through a series of stations where process workers carry out various operations on it — in a process referred to as work in process.

Once processing is complete, the goods are shipped to a warehouse as finished goods (FG)

Finally, these finished goods are sent out to customers.

Inventory Valuation

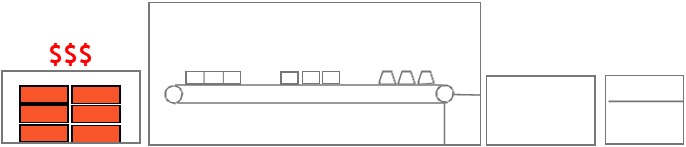

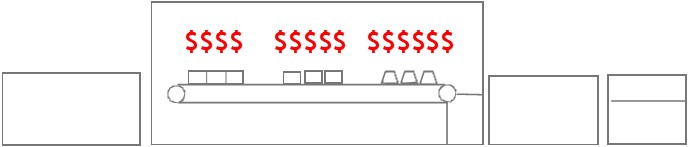

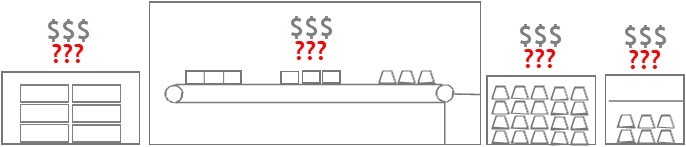

In the manufacturing process, raw materials start with a certain value.

Then value is added to those raw materials through the manufacturing process.

Eventually, the increase in value is reflected by the cost of goods sold.

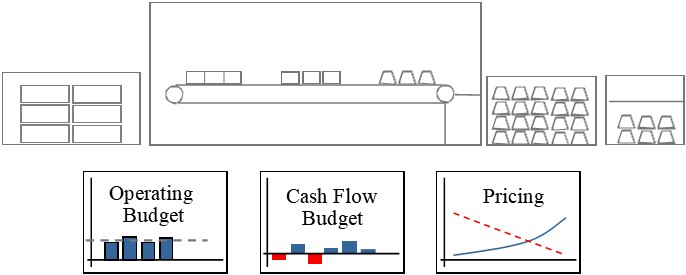

You need to keep track of inventory valuation all the way along.

This provides information for period-end reports—for budgeting—and for pricing.

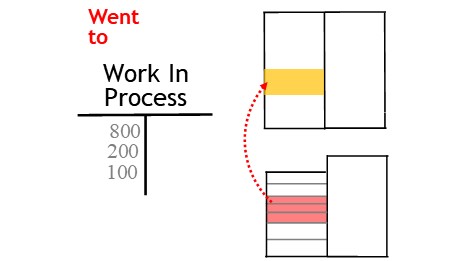

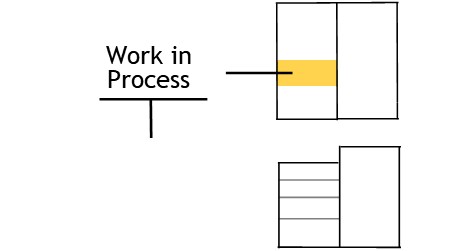

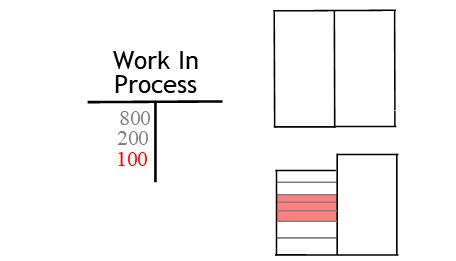

Work In Process Account

To keep track of inventory, you use several accounts.

One of these is the work-in-process account.

The work-in-process account is an asset account.

It tracks three costs.

- Direct Raw Materials

- Direct Labor

3 Manufacturing Overheads

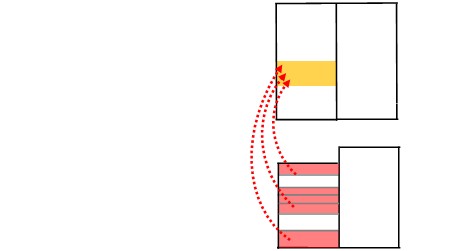

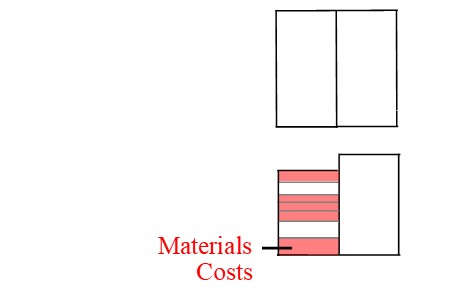

Direct Raw Materials

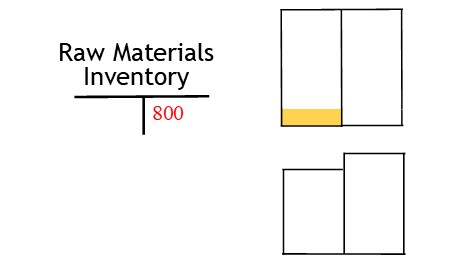

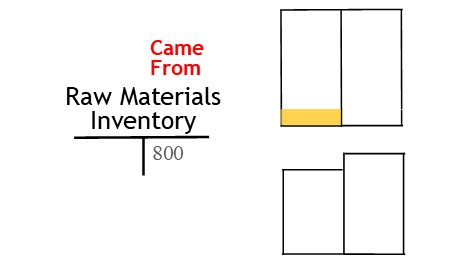

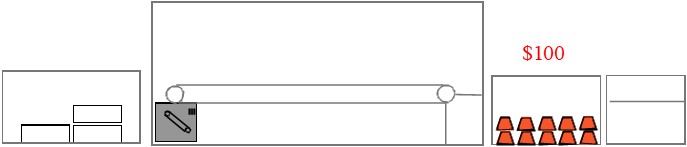

To begin the manufacturing process, factory workers take raw material out of the raw materials inventory.

Then they start processing it.

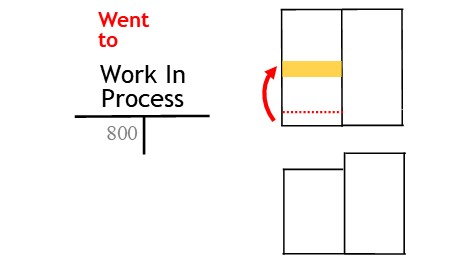

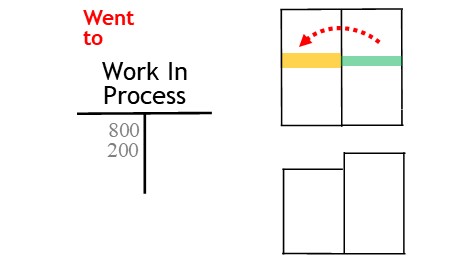

To update the accounts, you credit the raw materials inventory account.

This shows that the value of raw materials came from inventory.

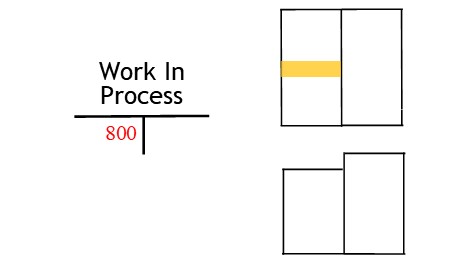

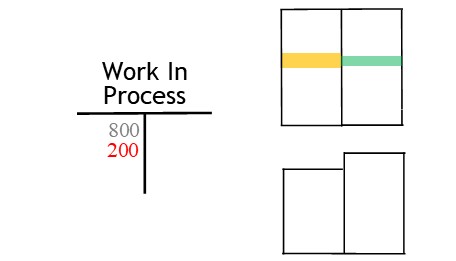

Next, you debit the work in process account.

This shows the materials went to be processed

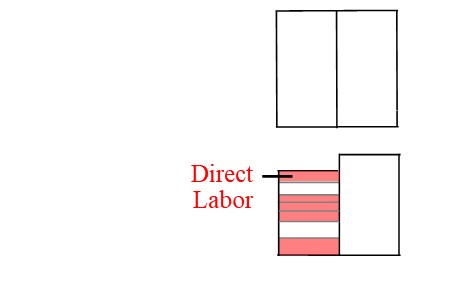

Direct Labor

In addition to the cost of materials, the work-in-process account needs to include direct labor costs.

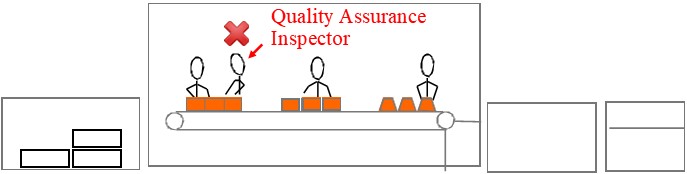

Direct labor costs include only those costs with those directly involved in the manufacturing process.

Other labor costs, such as those for testing and inspection, management, administration, etc. are not included in manufacturing overheads.

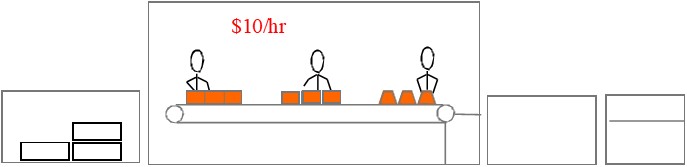

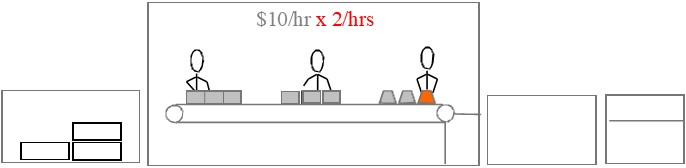

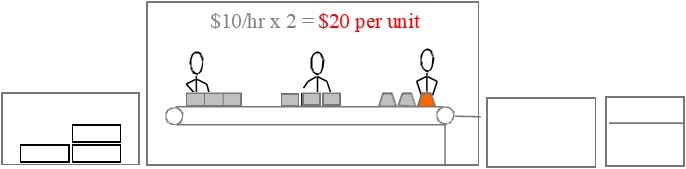

To determine direct labor costs, you take the hourly wage rate.

Then multiply this by the time it takes to produce 1 unit of product.

This provides a unit cost.

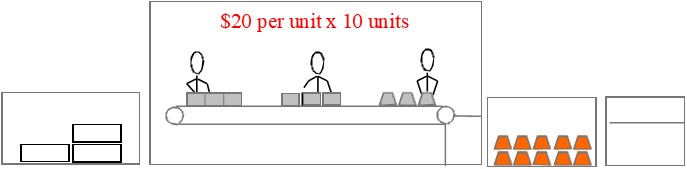

After this, you multiply the unit rate by the number of units manufactured.

This provides the direct labor component of the costing.

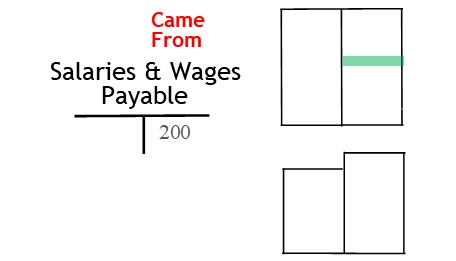

To update the accounts, you credit a liability account called wages & salaries payable account.

This shows the value assigned for direct labor will come from salaries and wages.

Next, you debit the work in process account.

This shows you have assigned the value to the asset account.

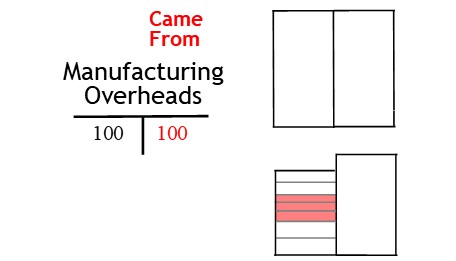

Manufacturing Overheads Account

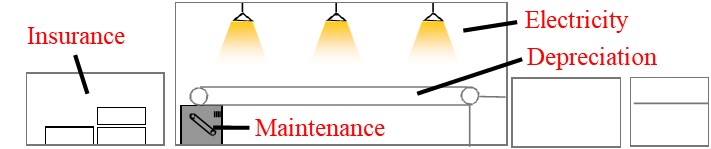

Manufacturing overheads include costs involved in running the manufacturing facility.

These costs include things like insurance, electricity, maintenance, salaries, and factory rent.

If there was an error, however, the trial balance wouldn’t balance.

They are indirect costs that can’t be allocated to the production of a single unit.

For example, you could divide total overhead costs by total machine hours to arrive at a cost per unit.

Then, in future costings, you apply this predetermined rate to the total number of units produced.

This will calculate a total value for manufacturing overhead.

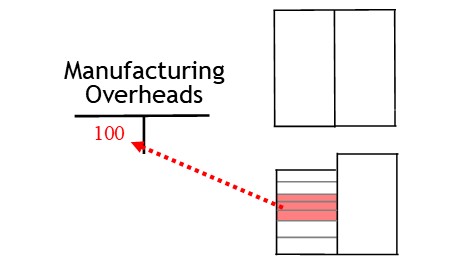

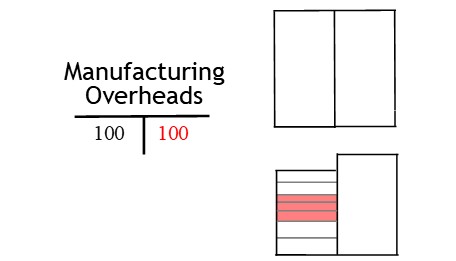

To update the accounts, you transfer these costs to a clearing account known as a manufacturing overheads account.

Next, you credit the account.

This shows you are moving the value from the clearing account.

Then you debit the work in process account.

This shows you have moved manufacturing overheads to the WIP account, as well.