Write Downs

What is a Write Down?

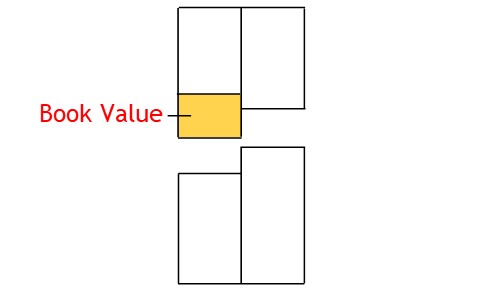

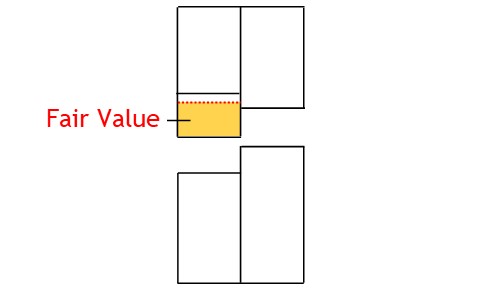

A write down is when you reduce the value of an asset from its book value to a lower fair value.

How it Works

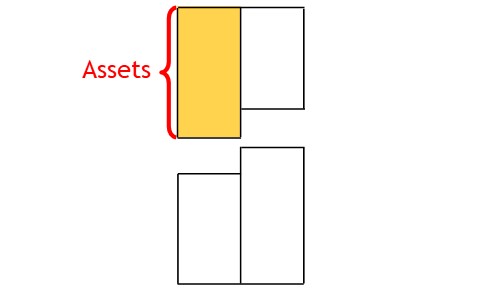

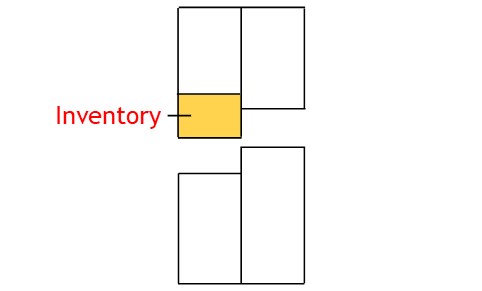

A business will have assets such as inventory, goodwill, accounts receivable, and plant and machinery.

These assets can lose value for various reasons.

For example, some unsold shelf stock may need to be discounted.

If this happens, you need to modify the inventory’s value.

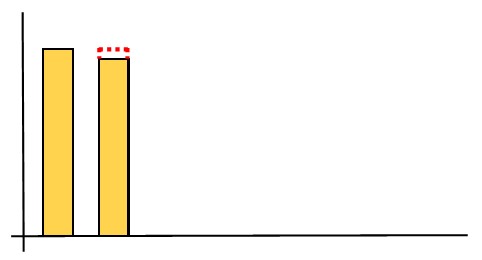

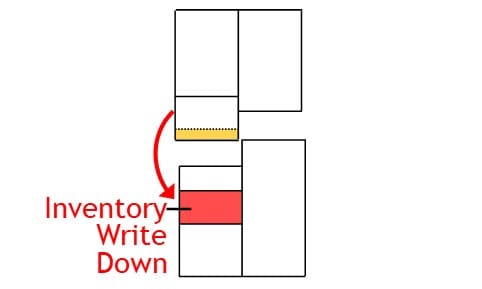

To do this, you take the inventory’s carrying value.

And reduce it to the lower fair value, which is the price at which you can currently sell it.

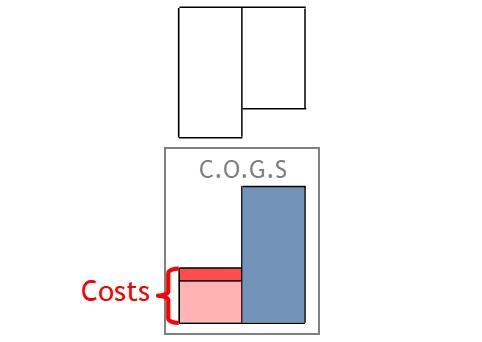

If the loss of value is insignificant, you allocate the expense to cost of goods sold.

This shows the loss is just another cost of making sales.

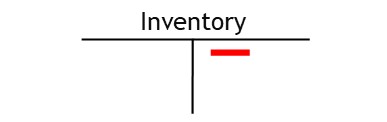

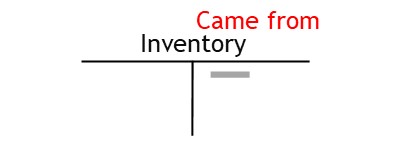

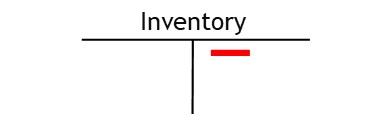

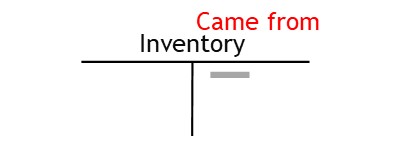

To write down the loss, you credit the inventory account.

This shows you have taken value from that account.

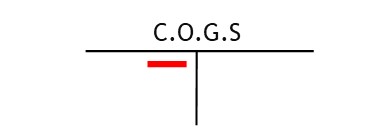

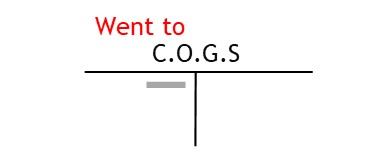

Then you debit the cost of goods sold account.

This shows you have allocated the expense as a cost of goods sold.

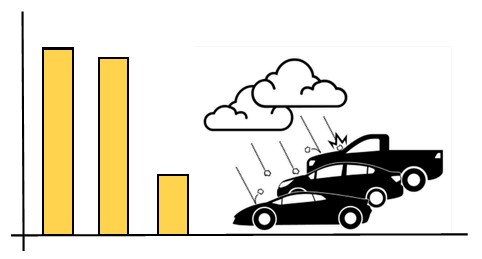

Sometimes assets will lose a lot of value suddenly.

For example, an inventory of cars may be suddenly damaged in a hail storm.

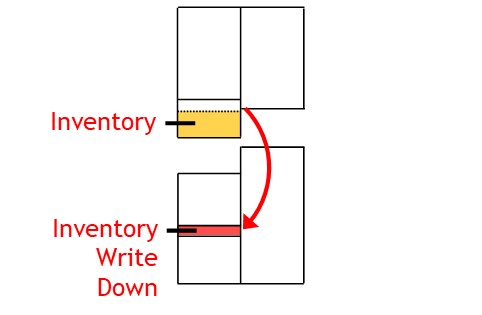

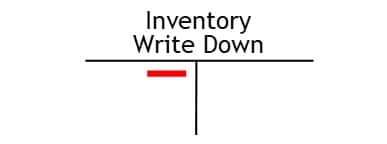

If the loss of value is significant, you allocate it to the inventory write down expense account.

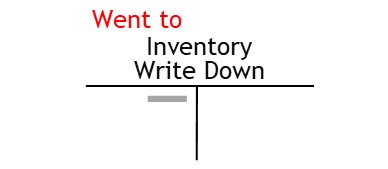

Again, you credit the inventory account.

This shows you have taken value from inventory.

After that, you debit the inventory write down expense account.

This shows you have allocated the loss of value to inventory write down.

© R.J. Hickman 2020