Amortization of Bond Discount

What Does Amortization of Bond Discount Mean?

Amortization of the bond discount is the write down of the discount over the bond term.

To read about Discount On Bonds Payable, click here

How It Works

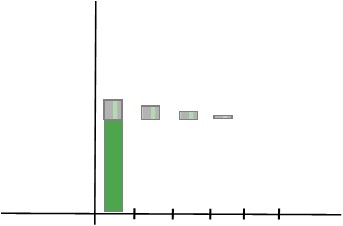

The bond discount is a cost to the issuer.

Each year, a portion of it needs to be shown as an expense.

This way, it can be matched against revenue in the period.

To do this, you amortize (write off) the discount over the course of the bond term.

You do this at the same time interest is paid.

By doing so, you will show how much the bond costs in total each period.

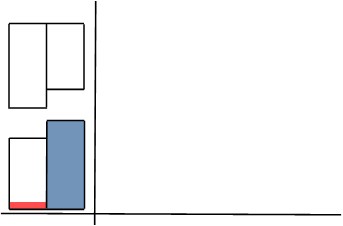

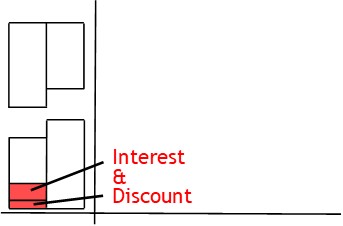

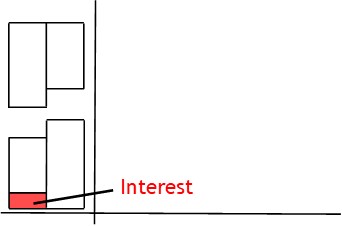

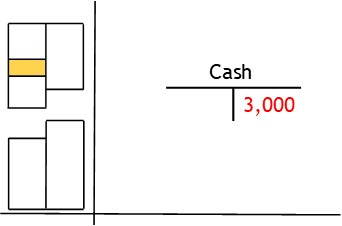

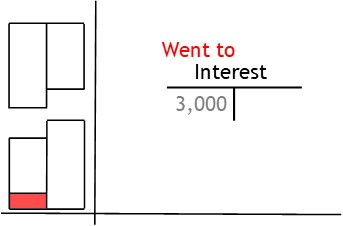

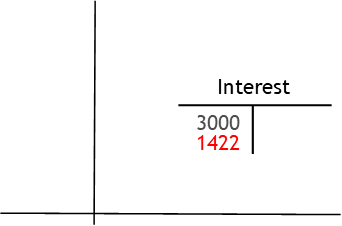

When recording the bond payment, you begin by recording the interest payment.

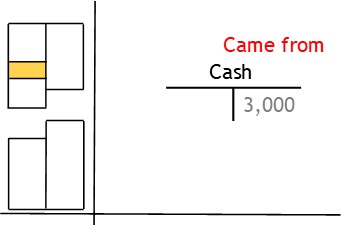

Here, you credit the checking account.

This shows money came from the bank.

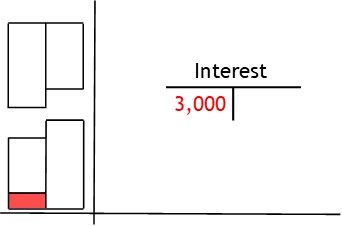

Then you debit the interest account.

This shows the money was used as interest expense.

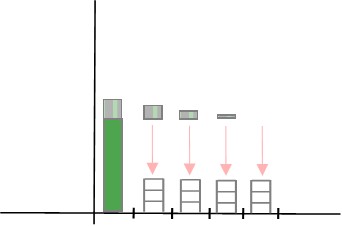

Next, you amortize the discount.

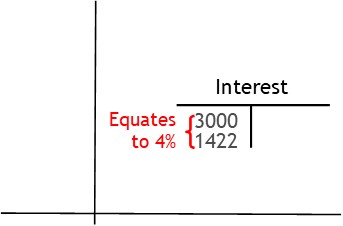

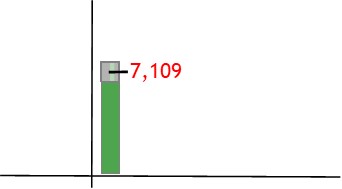

The information for this comes from a schedule you set up when the bonds are first issued.

It contains payment and discount details for each interest payment.

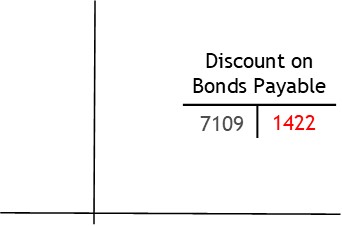

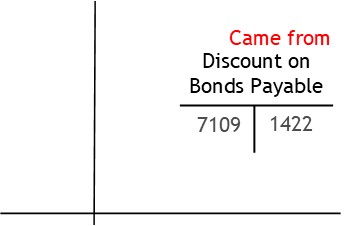

To do this, you credit the discount on bonds payable account.

This shows you are reducing the total discount by the amount of the annual portion.

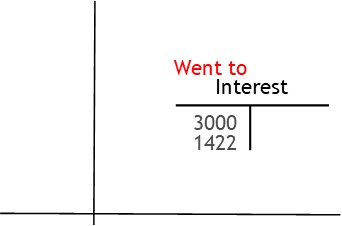

Then you debit the interest account.

This shows the money was added to interest expense.

Once updated, the interest account will show the higher rate of interest rate demanded by