Petty Cash

What is Petty Cash?

Petty cash is a small amount of money kept for small purchases such as postage and office supplies.

How it Works

A business will usually keep a small amount of cash on hand for incidental expenses.

This is known as petty cash.

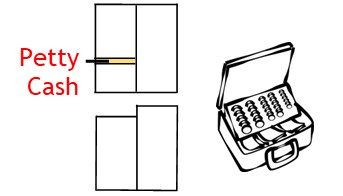

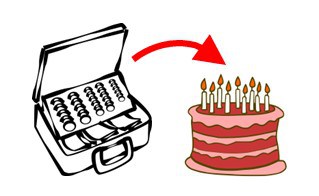

To set up petty cash, you withdraw money from the bank.

And you put that cash in the petty cash drawer.

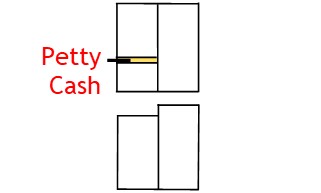

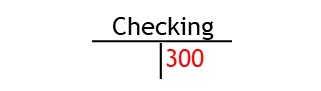

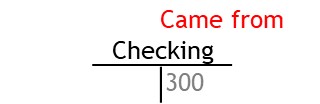

To record the set up transaction, you credit the checking account.

This shows you have taken money from the checking account.

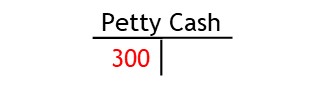

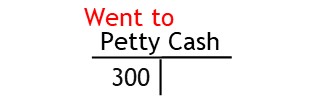

After this, you debit the petty cash account.

This shows the money was used for petty cash.

During the month, office staff may need to buy incidental office supplies.

They may also need to buy entertainment products for staff members.

When making a purchase, they take money from petty cash.

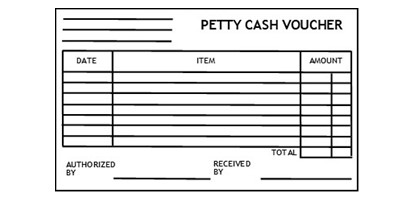

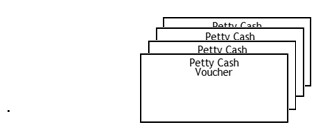

As they do this, they record the disbursement on a petty cash voucher.

Then they place the voucher in petty cash.

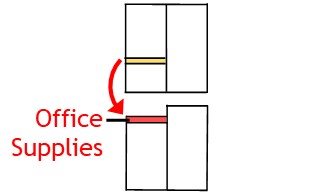

With petty cash transactions, you take money from petty cash and use it for various expenses.

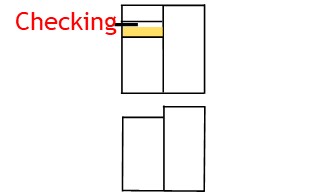

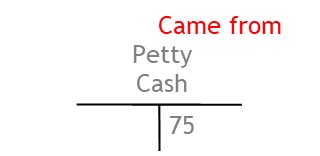

So to record a petty cash transaction, you credit the petty cash account.

This shows money came from petty cash.

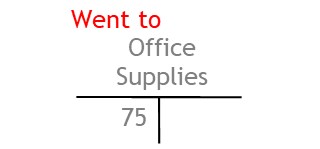

Then you debit the relevant expense account.

This shows the money was used for that particular expense.

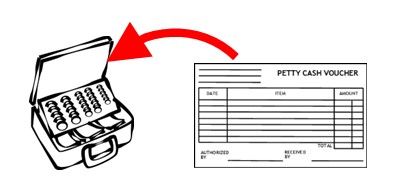

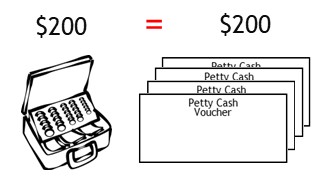

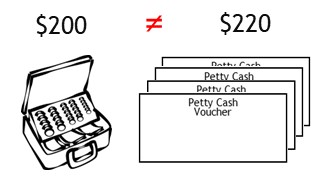

With the accounts updated, you tally the vouchers.

This will show how much money was taken out during the month

After this, you tally the money in petty cash.

This will show how much money was actually taken out.

The total of vouchers should equal the total of cash disbursed.

However, there may be a discrepancy.

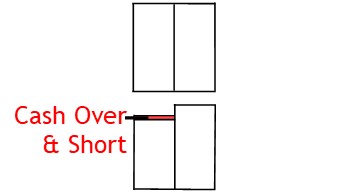

In this event, you need to record the discrepancy in the cash over and short expense account.

To see how to do this, click here ‘cash over & short account‘

© R.J. Hickman 2020