Accruals

What are Accruals?

Accrual accounts contain income and expenses that are yet to be invoiced by period-end.

How it Works

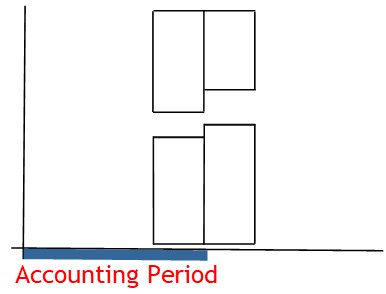

A business will make many transactions during an accounting period.

These transactions include sales.

They also include expenses.

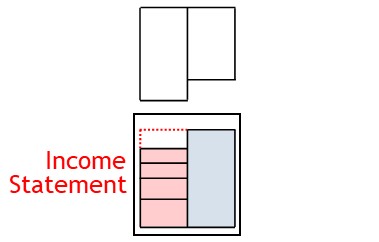

At period-end, you summarize these particular transactions in an income statement.

For that report to be accurate, it needs to contain an accurate record of all income and expenses for the period.

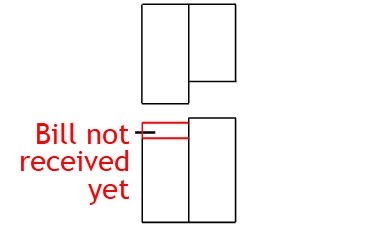

Often, though, the accounts don’t accurately reflect the true situation.

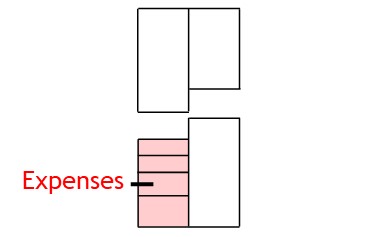

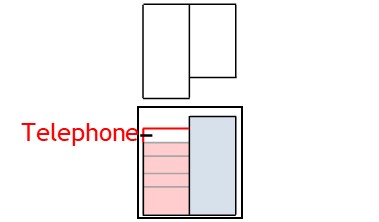

For example, the business may have incurred telephone expense during the period.

But it was yet to be invoiced for this expense as at period-end.

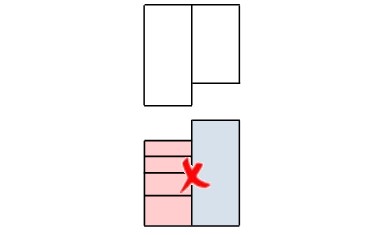

This means the period-end report will be missing an expense it really should show.

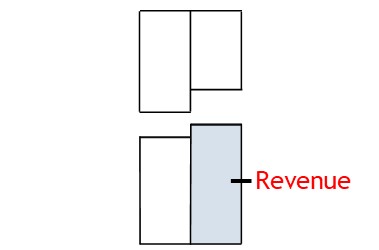

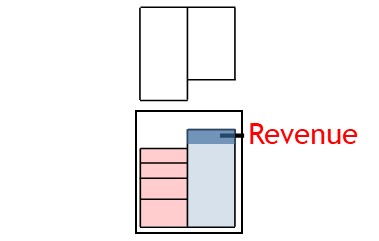

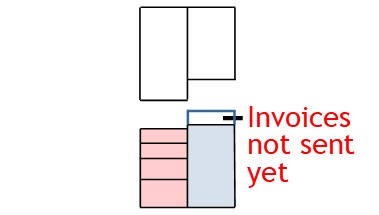

Similarly, the business may have done work for clients during the period.

The period-end report should show the income received from this work.

But as at period–end, the business may not yet have invoiced their clients for some of the work done.

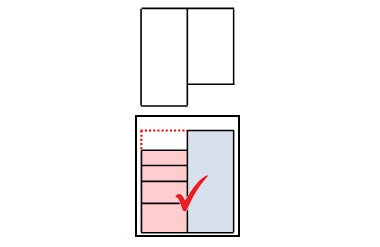

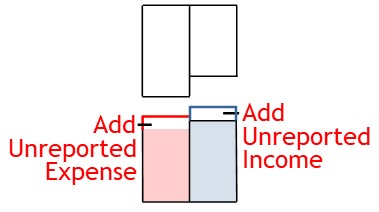

For the period-end report to be correct, you need to record unreported income and unreported expenses.

To do this, you need to adjust your accounts.

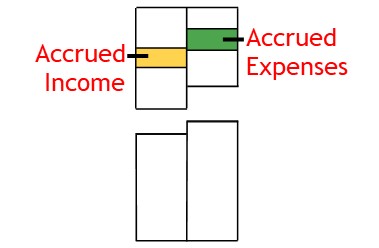

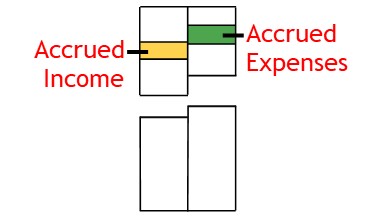

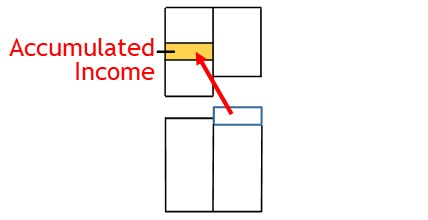

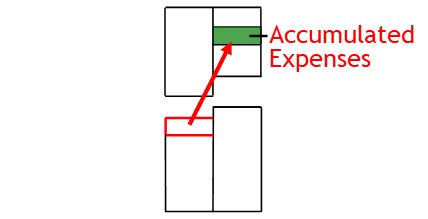

Income accrual accounts will show income that has accumulated over time and is yet to be received.

Expense accrual accounts will show expenses that have accumulated over time but that are yet to be paid.

To see how to record accruals, see accrued expenses and accrued income

© R.J. Hickman 2020